Working with Behavioral Data

Overview

Learning about customers through the data collected through business and relationship management systems.

Larry Vincent,

Professor of the Practice, Marketing

MKT 512

October 22, 2025

Behavioral data and customer profiling

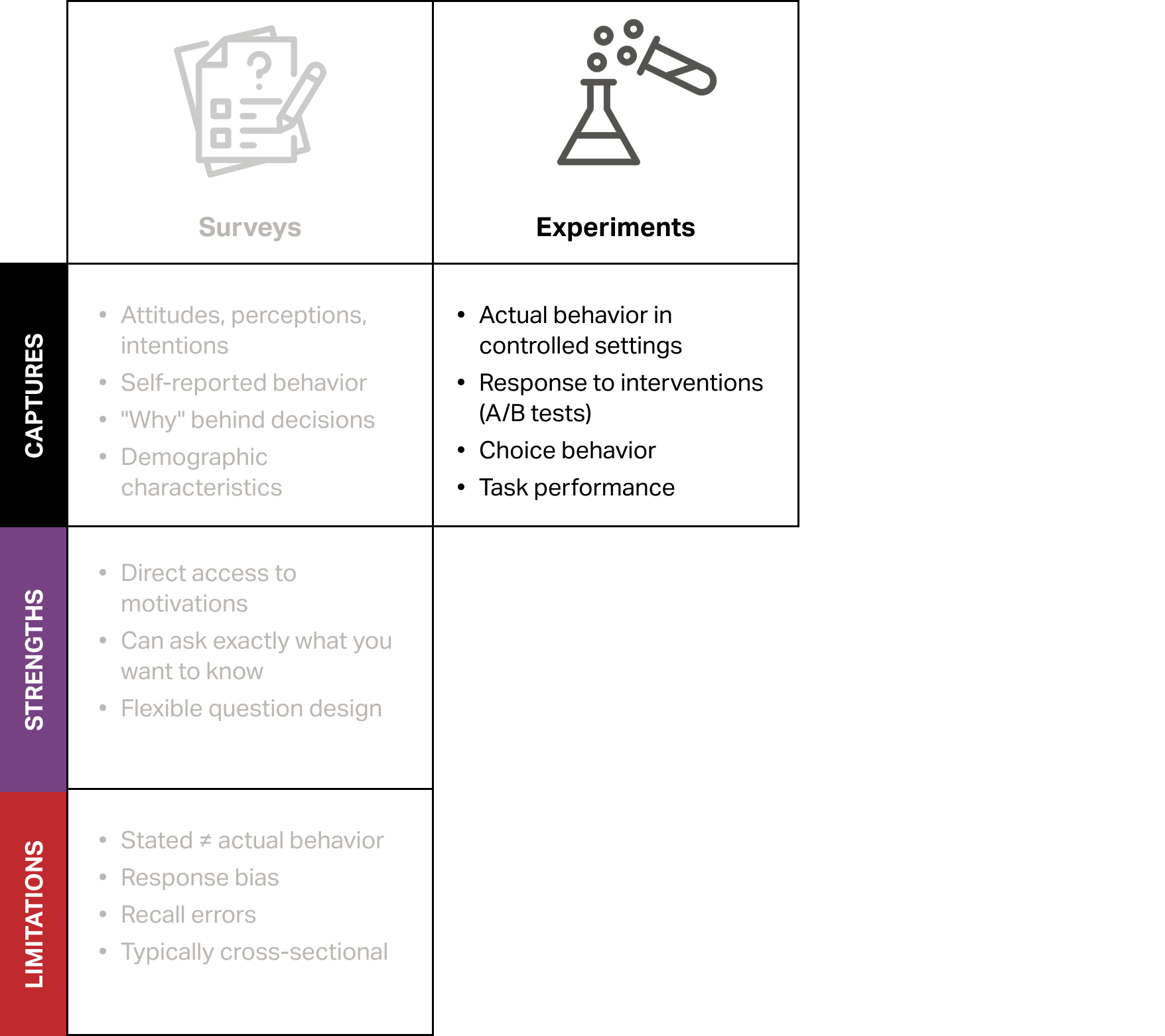

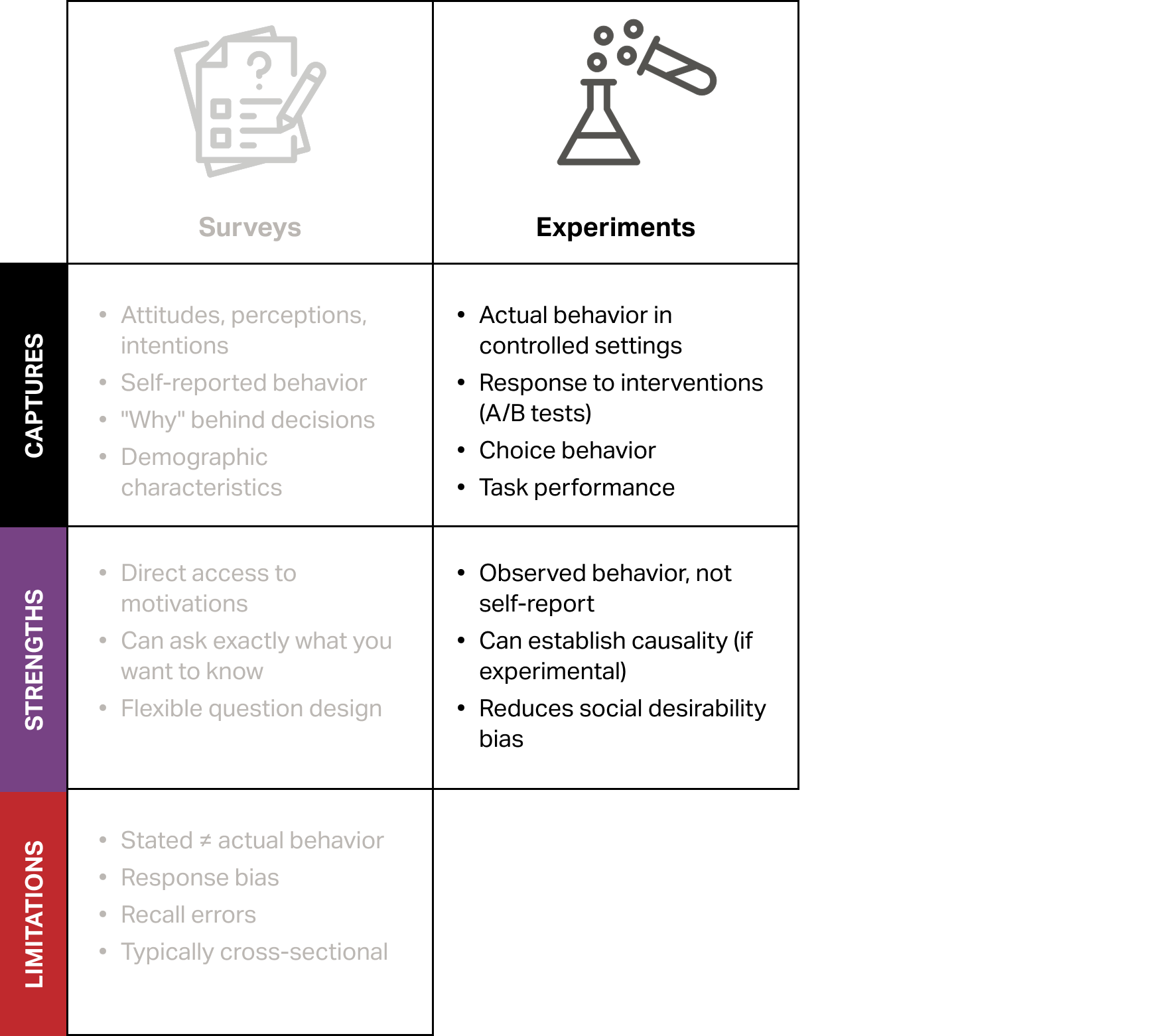

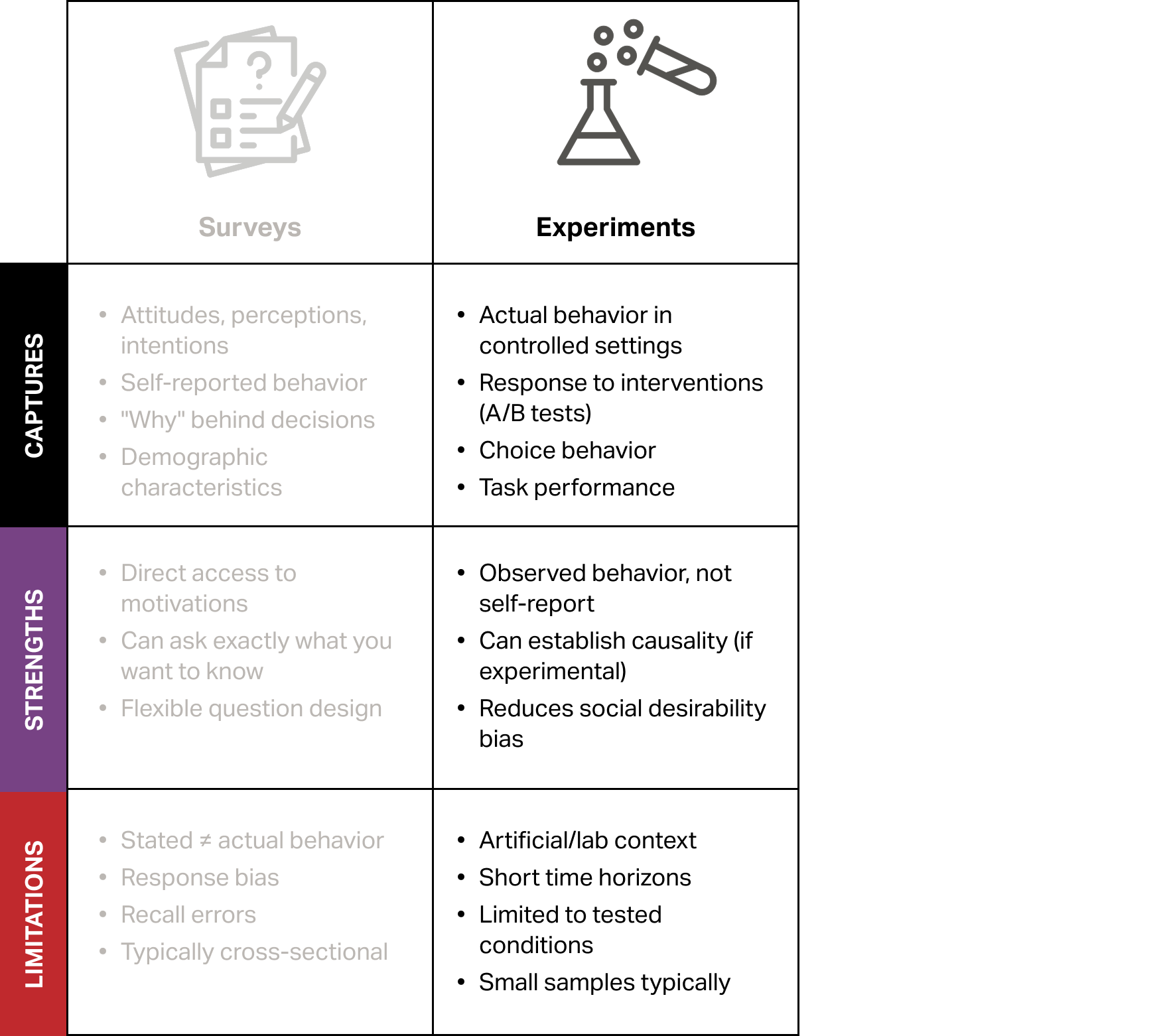

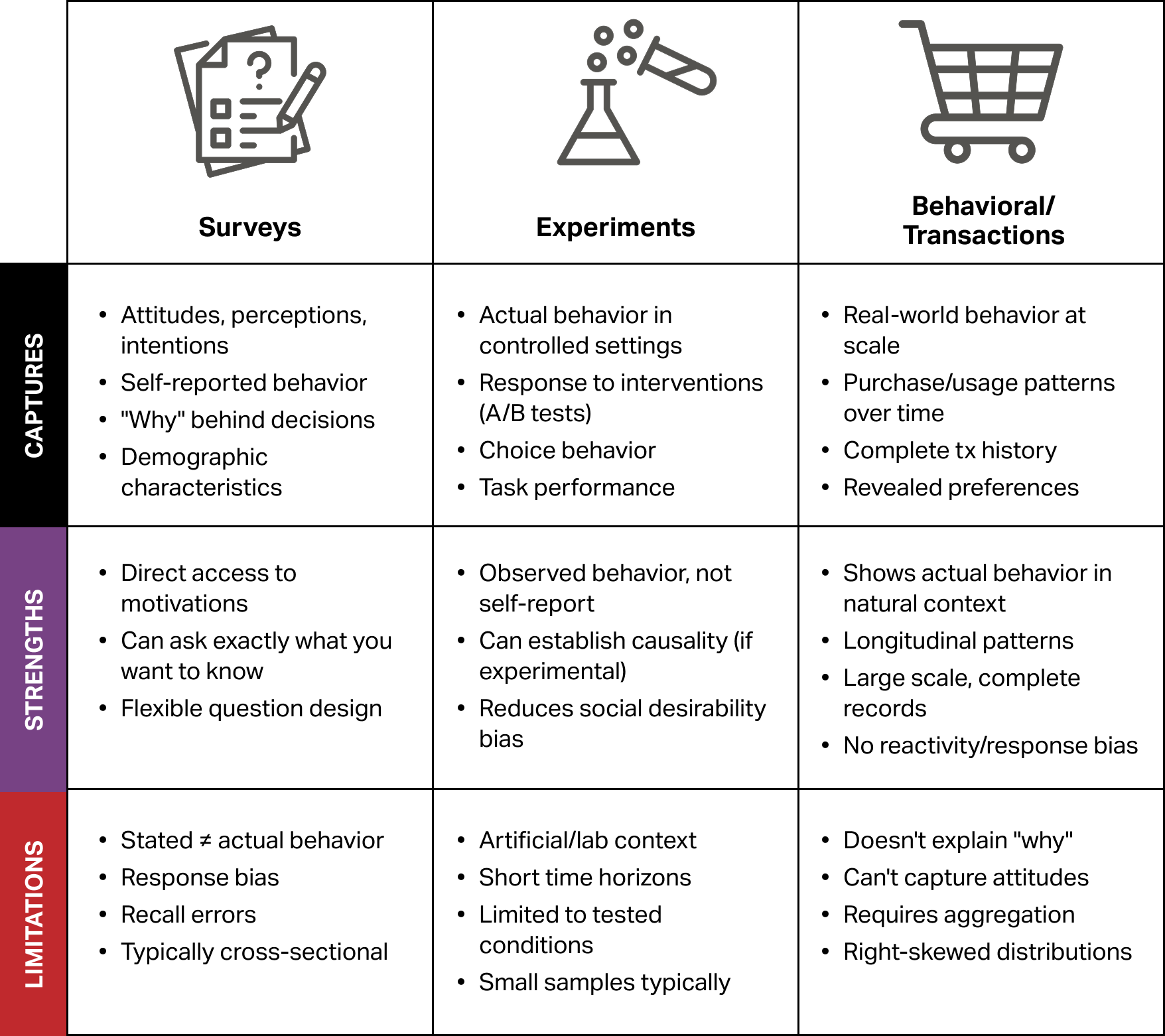

Comparing options

Comparing options

Comparing options

Comparing options

Comparing options

Comparing options

Comparing options

Comparing options

Comparing options

Comparing options

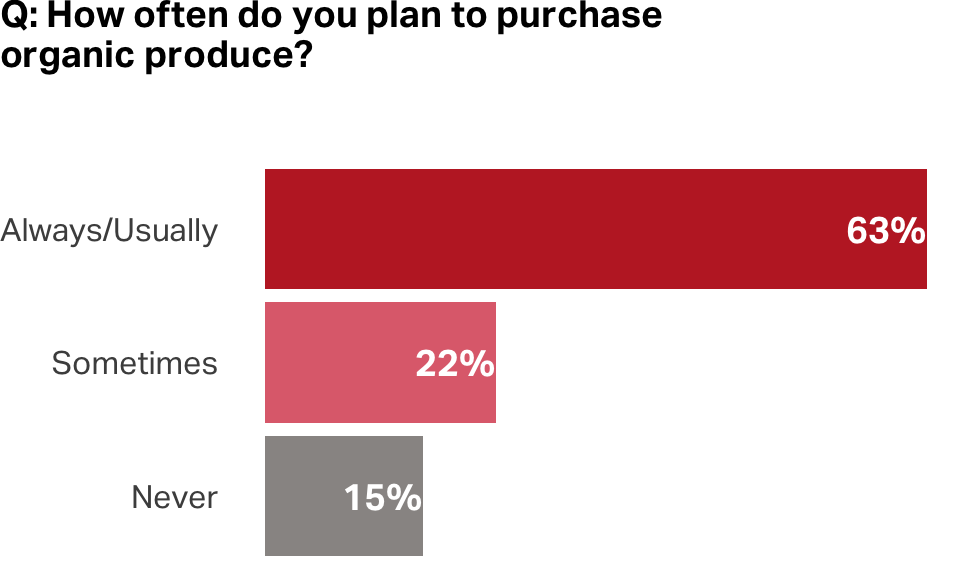

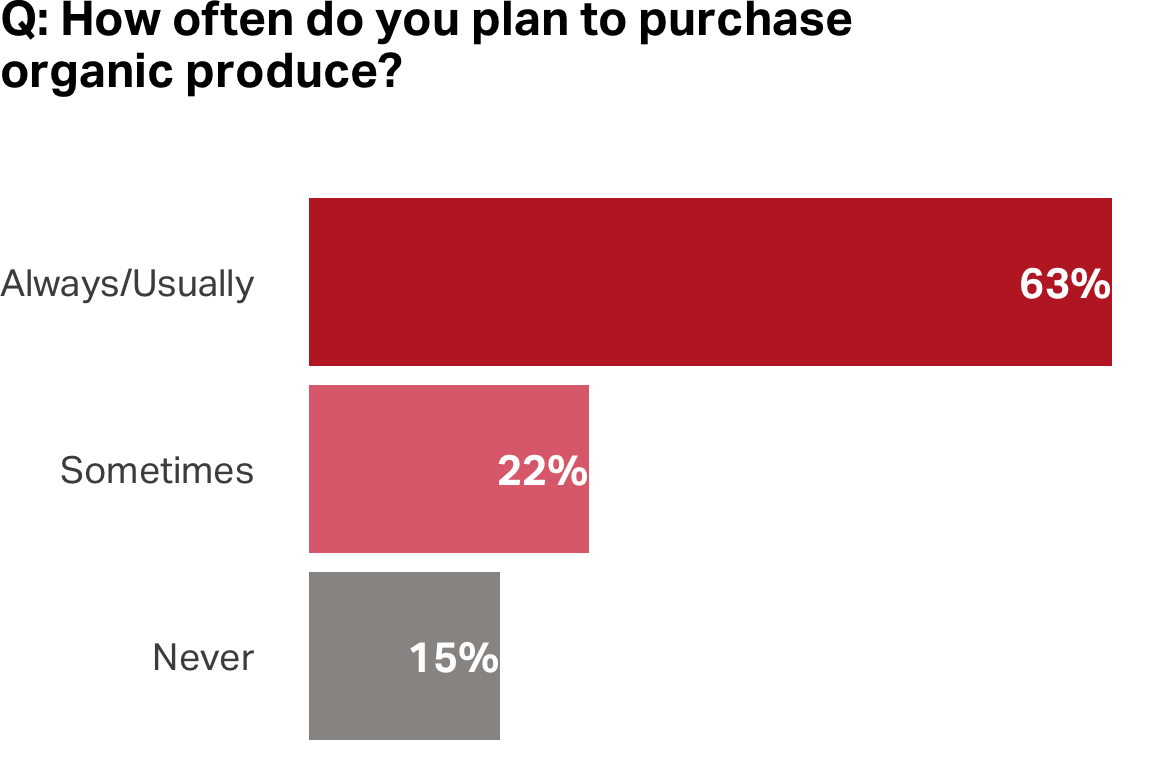

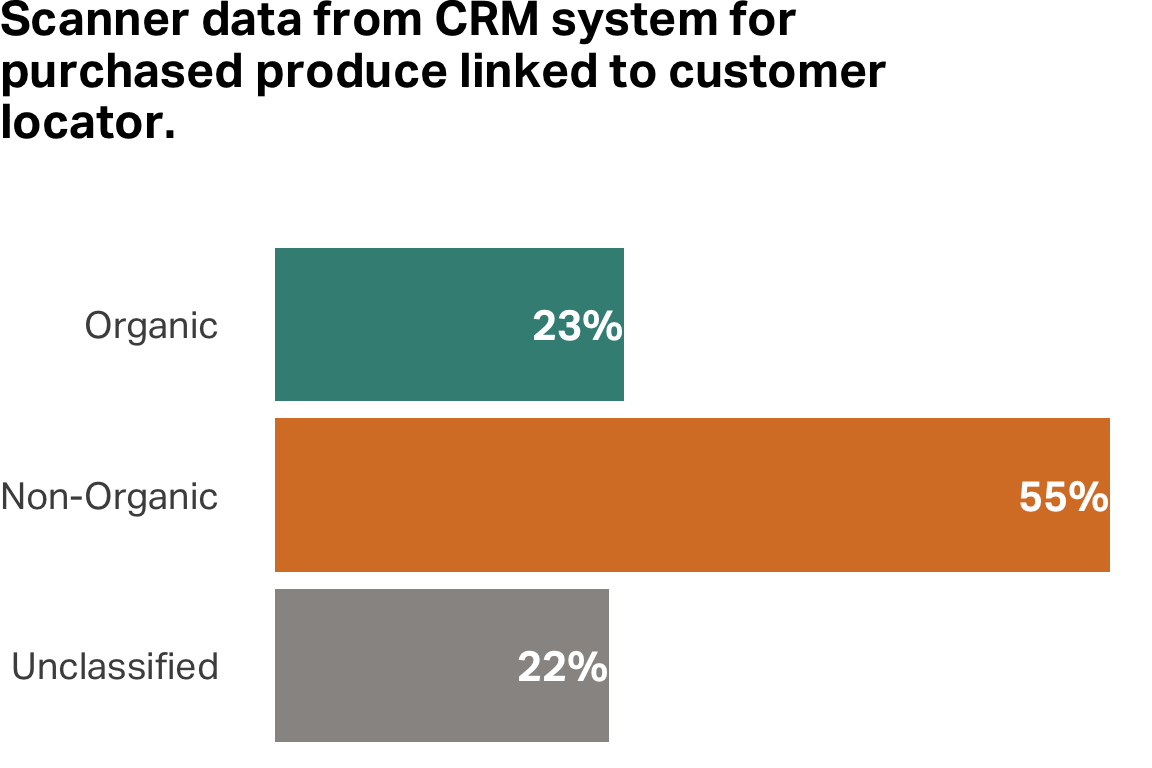

Stated preferences vs. revealed

Stated preferences vs. revealed

Most used behavior metrics

- Recency–How recently have they engaged with us?

Most used behavior metrics

- Recency–How recently have they engaged with us?

- Frequency–How often do they tend to engage with us?

Most used behavior metrics

- Recency–How recently have they engaged with us?

- Frequency–How often do they tend to engage with us?

- Velocity–Is their behavior accelerating, declining or stable?

Most used behavior metrics

- Recency–How recently have they engaged with us?

- Frequency–How often do they tend to engage with us?

- Velocity–Is their behavior accelerating, declining or stable?

- Monetary–How much do they typically spend or how much have they spent since originating?

Sample data

We will be working with a synthetic data set for a fictional company. The data set has four columns, transaction_id, customer_id, transaction_date, and transaction_amount.

File: customer-transactions-data.csv

| transaction_id | customer_id | transaction_date | transaction_amount |

|---|---|---|---|

| TXN0000001 | CUST04313 | 2023-01-01 | 118.43 |

| TXN0000002 | CUST00041 | 2023-01-02 | 111.25 |

| TXN0000003 | CUST00152 | 2023-01-02 | 118.83 |

| TXN0000004 | CUST00293 | 2023-01-02 | 54.96 |

| TXN0000005 | CUST00341 | 2023-01-02 | 139.38 |

| TXN0000006 | CUST00498 | 2023-01-02 | 83.58 |

Transforming to customer data

# Set a cutoff point--here it's the day after the last transaction date

ANALYSIS_DATE <- as_date("2025-10-01")

# Group by customer to calculate customer behaviors

customers_df <- df |>

group_by(customer_id) |>

summarise(

last_transaction = max(transaction_date),

recency = as.numeric(ANALYSIS_DATE - last_transaction),

frequency = n(),

monetary = sum(transaction_amount),

avg_tx = mean(transaction_amount)

)Transforming to customer data

# Set a cutoff point--here it's the day after the last transaction date

ANALYSIS_DATE <- as_date("2025-10-01")

# Group by customer to calculate customer behaviors

customers_df <- df |>

group_by(customer_id) |>

summarise(

last_transaction = max(transaction_date),

recency = as.numeric(ANALYSIS_DATE - last_transaction),

frequency = n(),

monetary = sum(transaction_amount),

avg_tx = mean(transaction_amount)

)# A tibble: 6 × 6

customer_id last_transaction recency frequency monetary avg_tx

<chr> <date> <dbl> <int> <dbl> <dbl>

1 CUST00001 2025-01-01 273 4 318. 79.5

2 CUST00002 2025-07-15 78 4 279. 69.8

3 CUST00003 2025-09-26 5 18 1952. 108.

4 CUST00004 2025-09-06 25 19 1728. 90.9

5 CUST00005 2025-09-11 20 8 787. 98.4

6 CUST00006 2025-09-24 7 66 14967. 227. Recency

Recency

The number of days (or time period) since a customer’s last transaction or interaction.

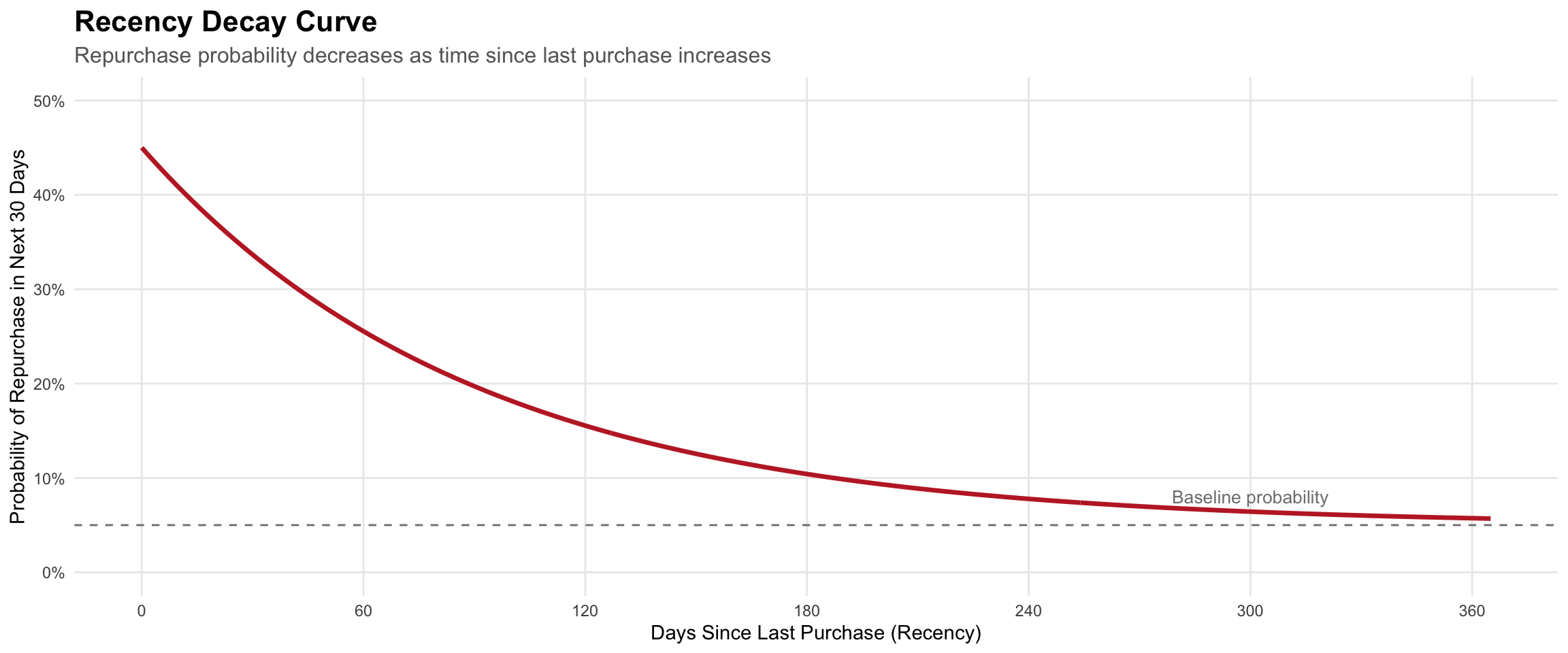

Decay curve

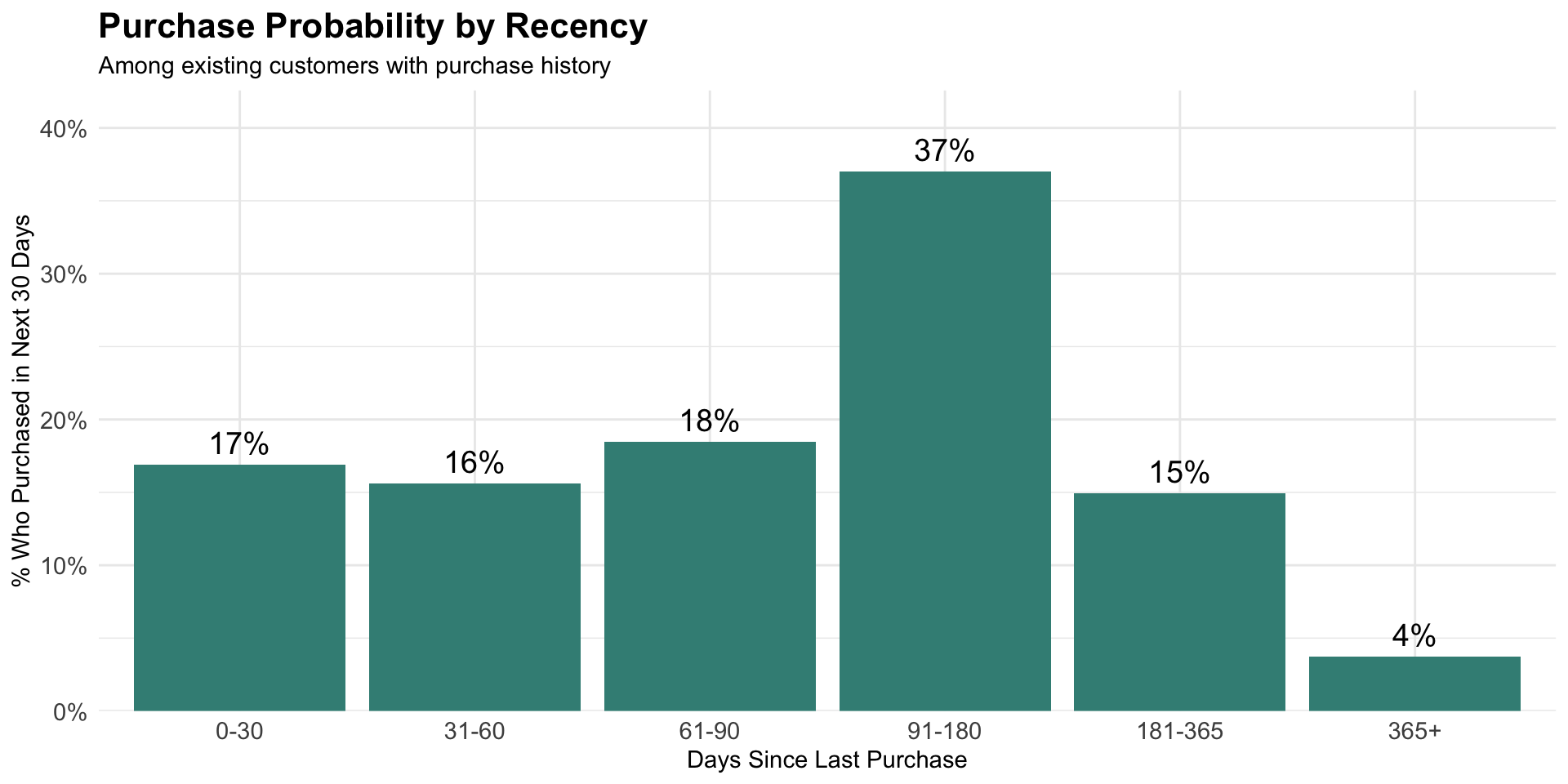

Customer repurchase probability decays over time, though the rate varies dramatically by category (fast-moving consumer goods decay quickly; durable goods like appliances show flat patterns).

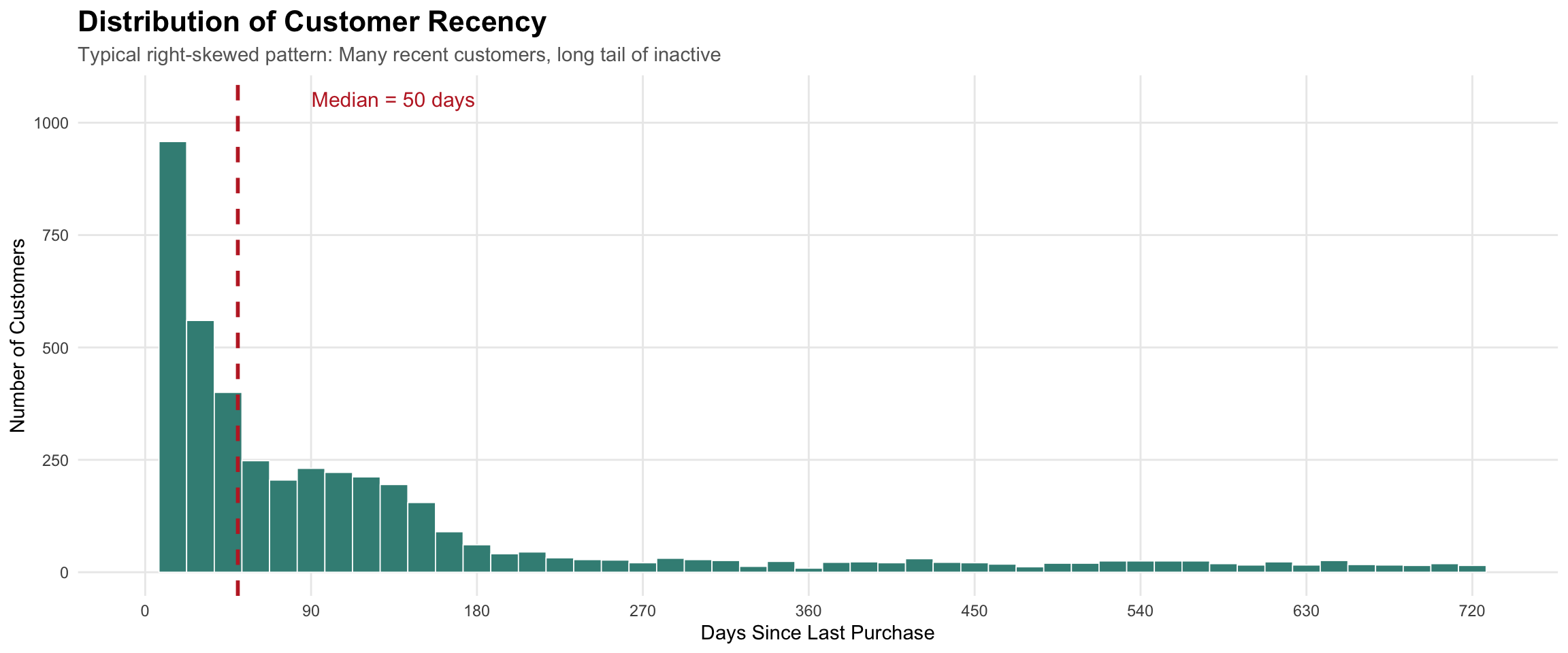

Analyzing recency patterns

Notice the concentration of customers with recent purchases (left side) and the long tail of inactive customers extending to the right—this pattern suggests most customers are engaged, but you have a significant inactive segment requiring re-engagement strategies.

Predictive Models

Recency scores can help us understand common patterns and probability of purchase within certain windows. These probabilities can be used to optimize marketing mix decisions.

Recency needs context

Two customers with same recency (30 days)

Customer A: Second purchase in < 30 days

→ Promising new customer

Customer B: Only purchase in 2 years

→ At-risk, declining customer

We need additional context

- How often do they engage?

- How much do they spend?

- Are they accelerating or declining?

With this context, you can then develop strategy.

- Winback lapsing and at-risk customers or take the win but don’t waste resources on inconsistent or opportunistic customers

- Incentivize return visit from new customer or target for special offer/reward

Next: Frequency as the second behavioral dimension

Frequency

Frequency

The number of transactions or interactions a customer has made within a specified time period.

Frequency as count data

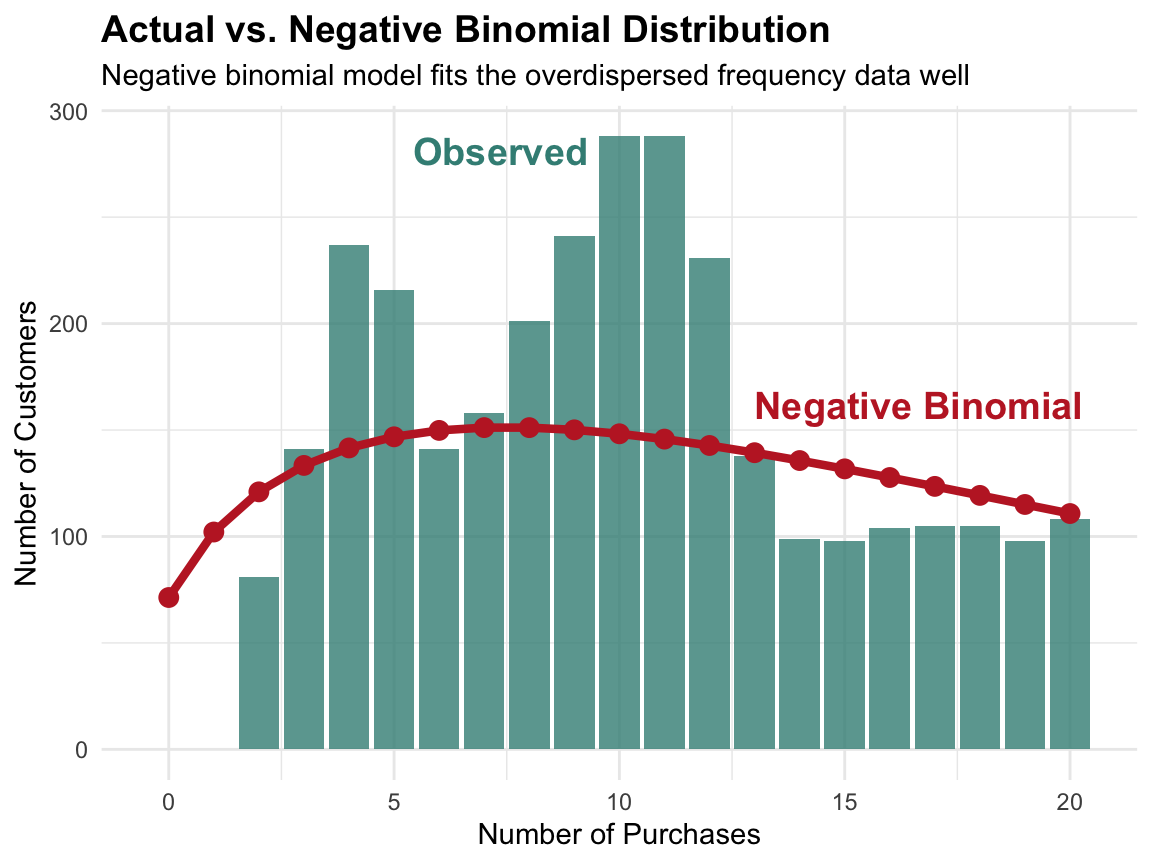

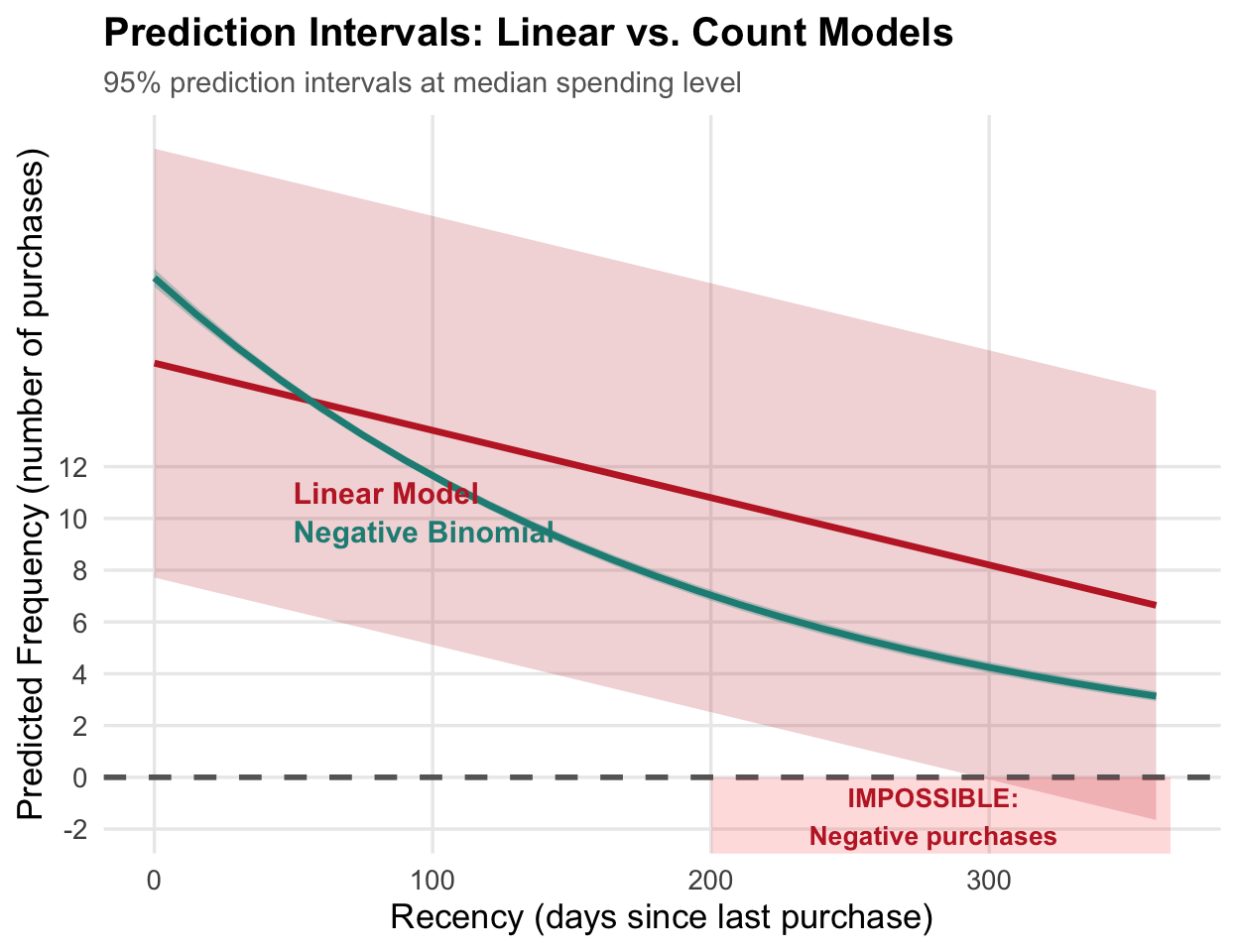

Frequency is count data (integers ≥ 0), which requires specialized statistical methods. When the variance exceeds the mean (overdispersion) or there’s excess zeros, negative binomial or zero-inflated models are more appropriate than standard linear regression.

Properties of Count Data:

- Only non-negative integers (0, 1, 2, 3…)

- Cannot be averaged meaningfully

- Variance often increases with mean

- Excess zeros common (many one-time purchasers)

Statistical approaches:

- Poisson regression (if mean ≈ variance)

- Negative binomial (if overdispersed)

- Zero-inflated models (if excess zeros)

Frequency is context-dependent

What constitutes “high frequency” varies dramatically by business model and product category. A metric that signals engagement in one industry may indicate completely different behavior in another.

| Business Model | High Frequency | Interpretation |

|---|---|---|

| Coffee Shop | 20+ visits/month | Daily regular |

| Grocery Store | 2-3 visits/week | Weekly shopper |

| E-commerce Fashion | 8-12 orders/year | Fashion enthusiast |

| SaaS (B2B) | Daily logins | Power user |

| Luxury Auto | 1 purchase/5 years | Repeat customer (rare!) |

| Streaming Service | Daily usage | Core subscriber |

Count data requires care

Linear regression on count data produces nonsensical prediction intervals that include negative frequencies—an impossibility for count data.

# Wrong approach: Linear model

lm_model <- lm(frequency ~ recency + monetary,

data = customers_df)

# Prediction intervals

predict(lm_model, interval = "prediction")

# Right approach: Negative binomial

# using glm.nb function from MASS package

nb_model <- glm.nb(frequency ~ recency + monetary,

data = customers_df)Key Problem: Linear model assumes constant variance and normal errors—both violated with count data.

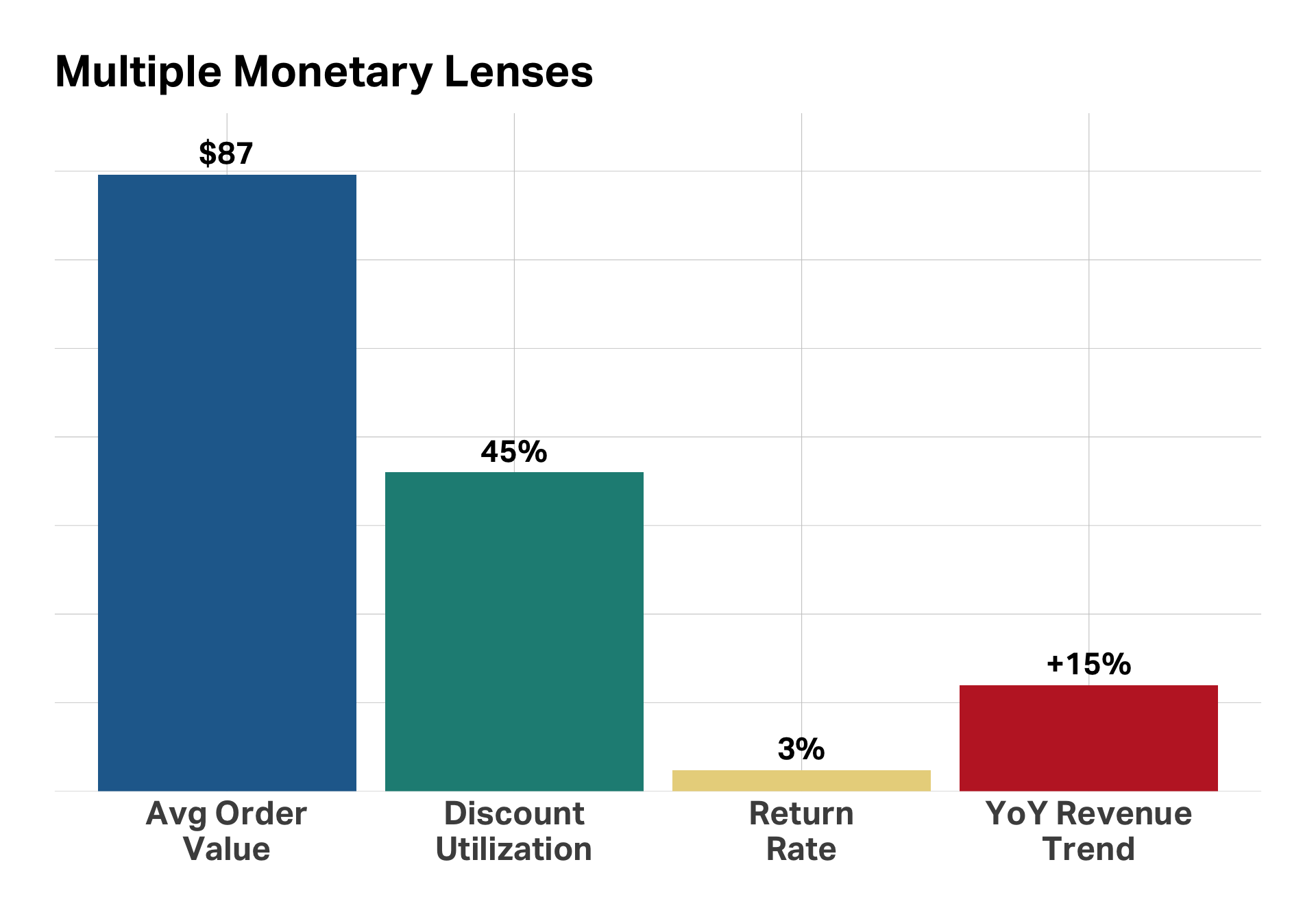

Monetary value

Monetary value

The financial dimension of customer behavior, revealing spending patterns, preferences, and relationship depth beyond simple revenue totals

Beyond the total

Customer Profile

Lifetime Spend:

$5,240

Transactions:

60

Time Period:

36 months

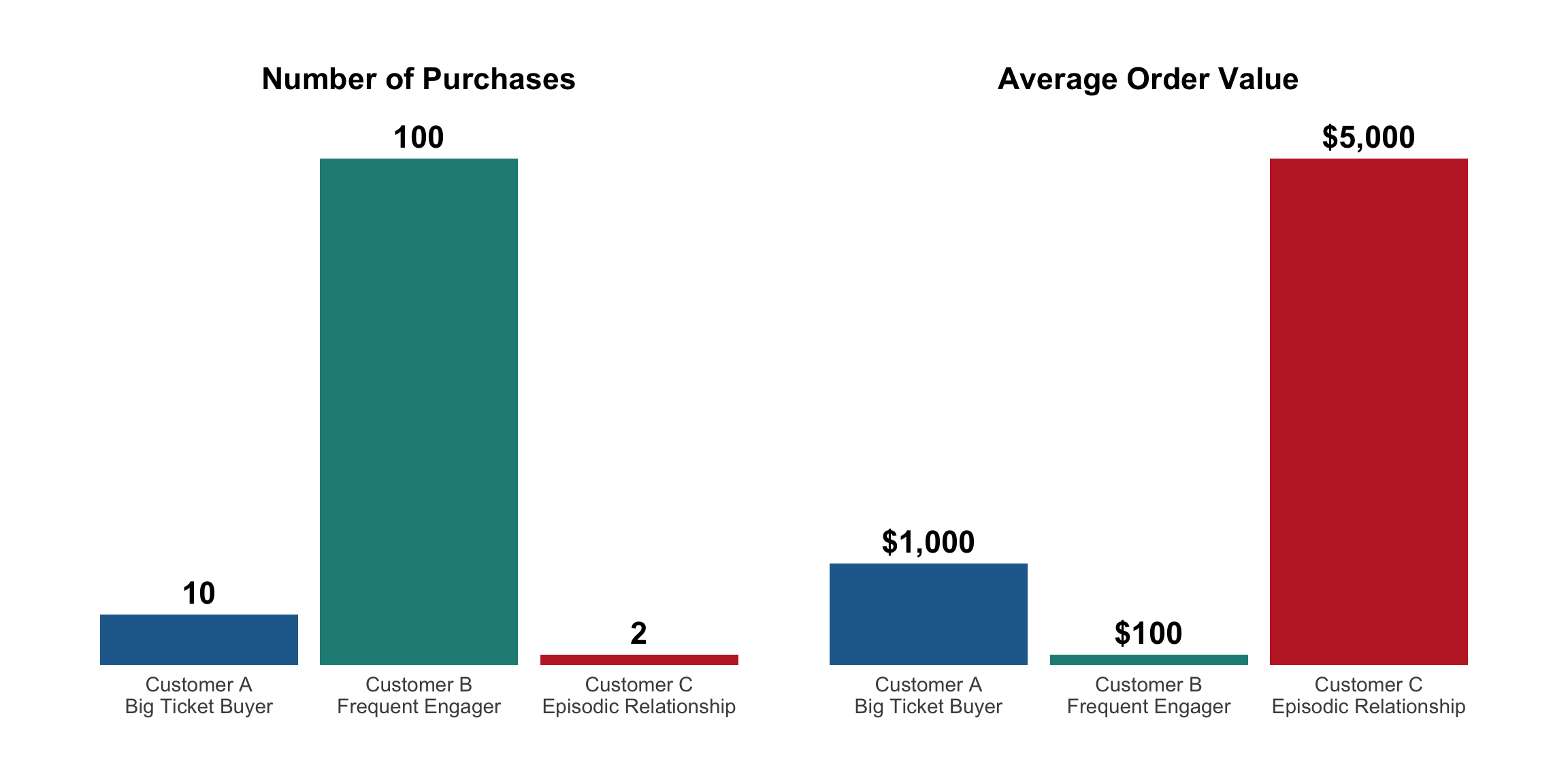

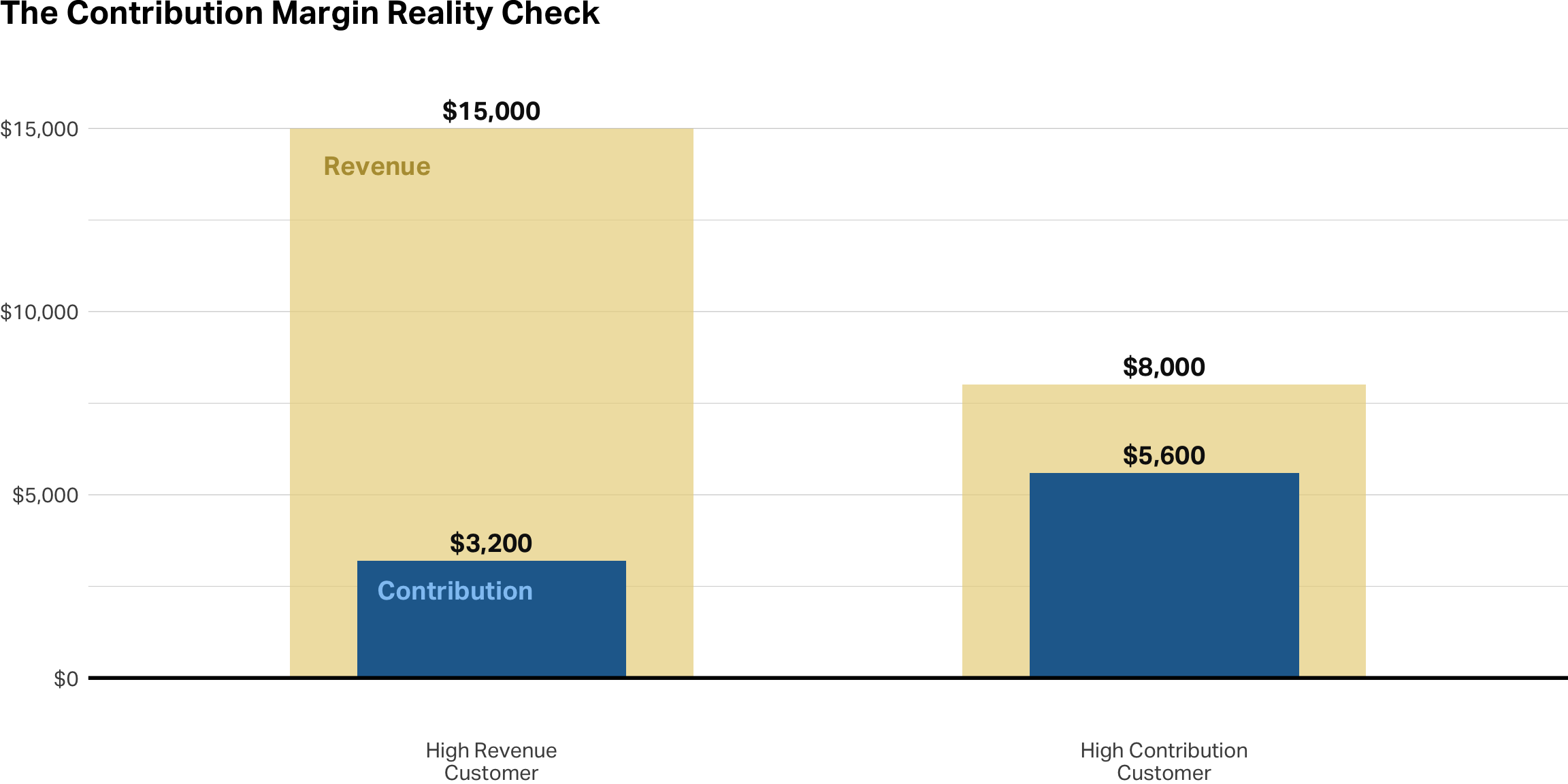

All revenue is not equal

Identical revenue ($10,000), completely different relationships and strategies needed

Revenue ≠ Value

Behavioral patterns (discount seeking, returns) directly impact true value

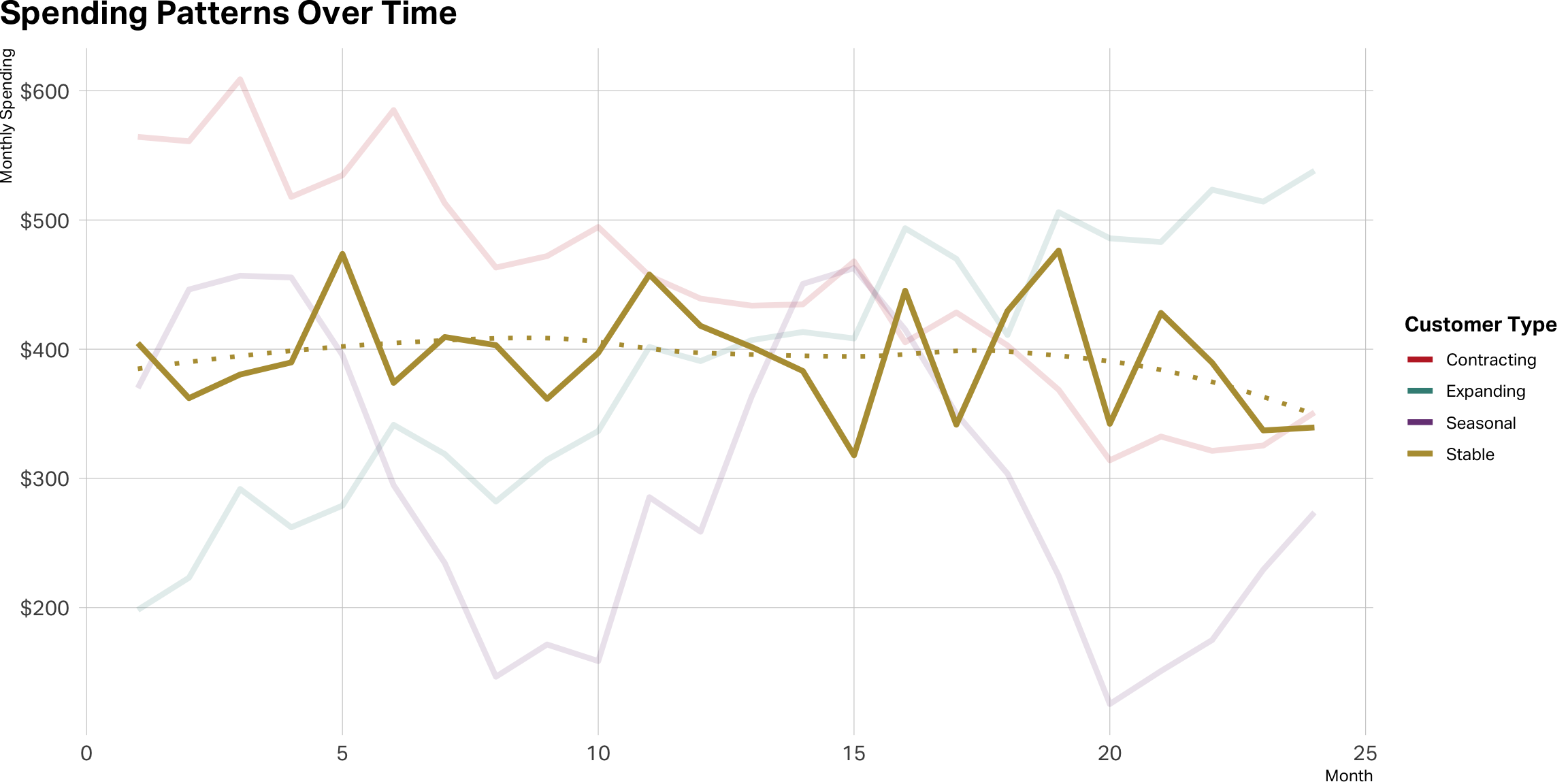

Stable is not a straight line

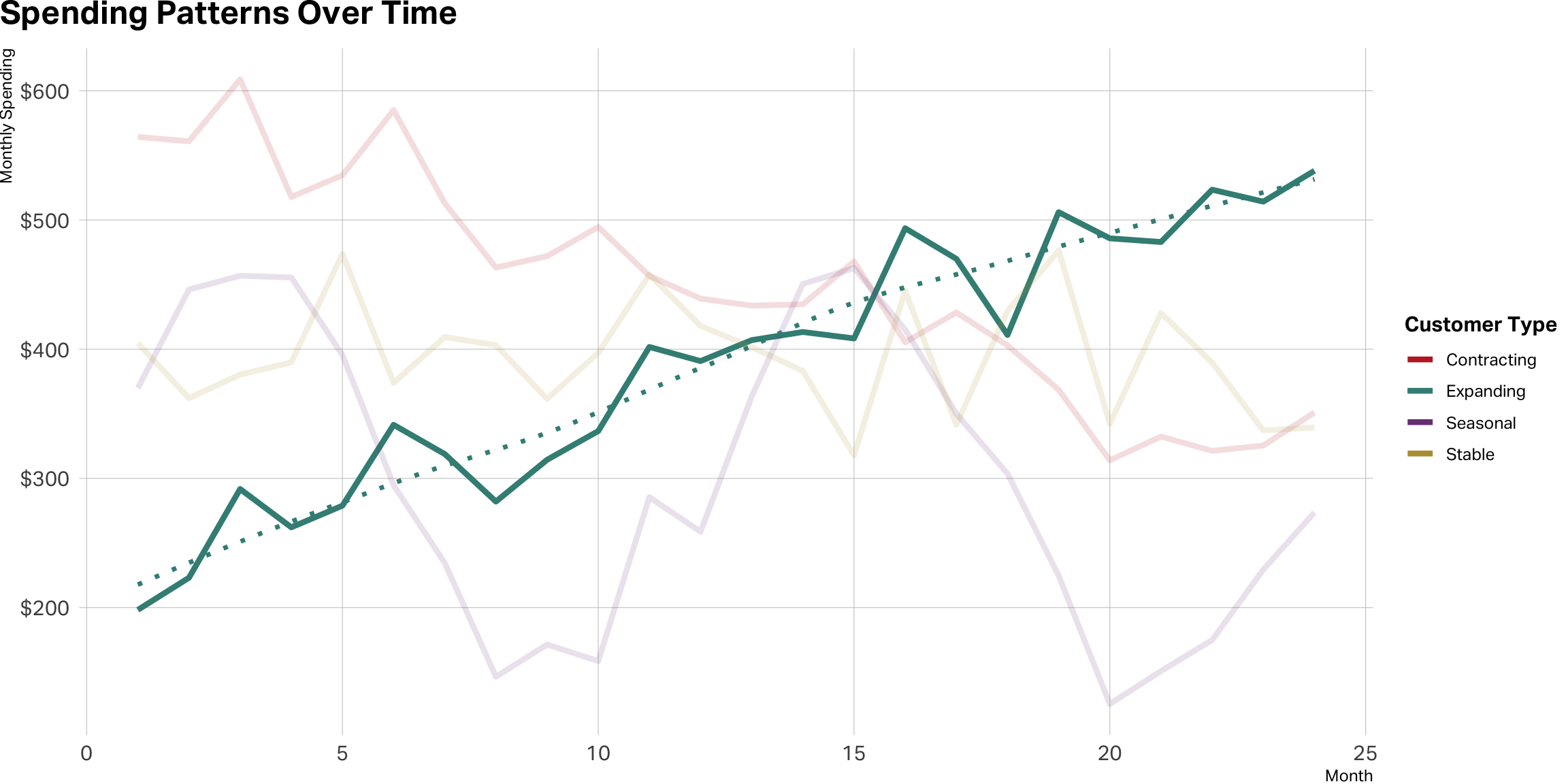

Lean in on expansion

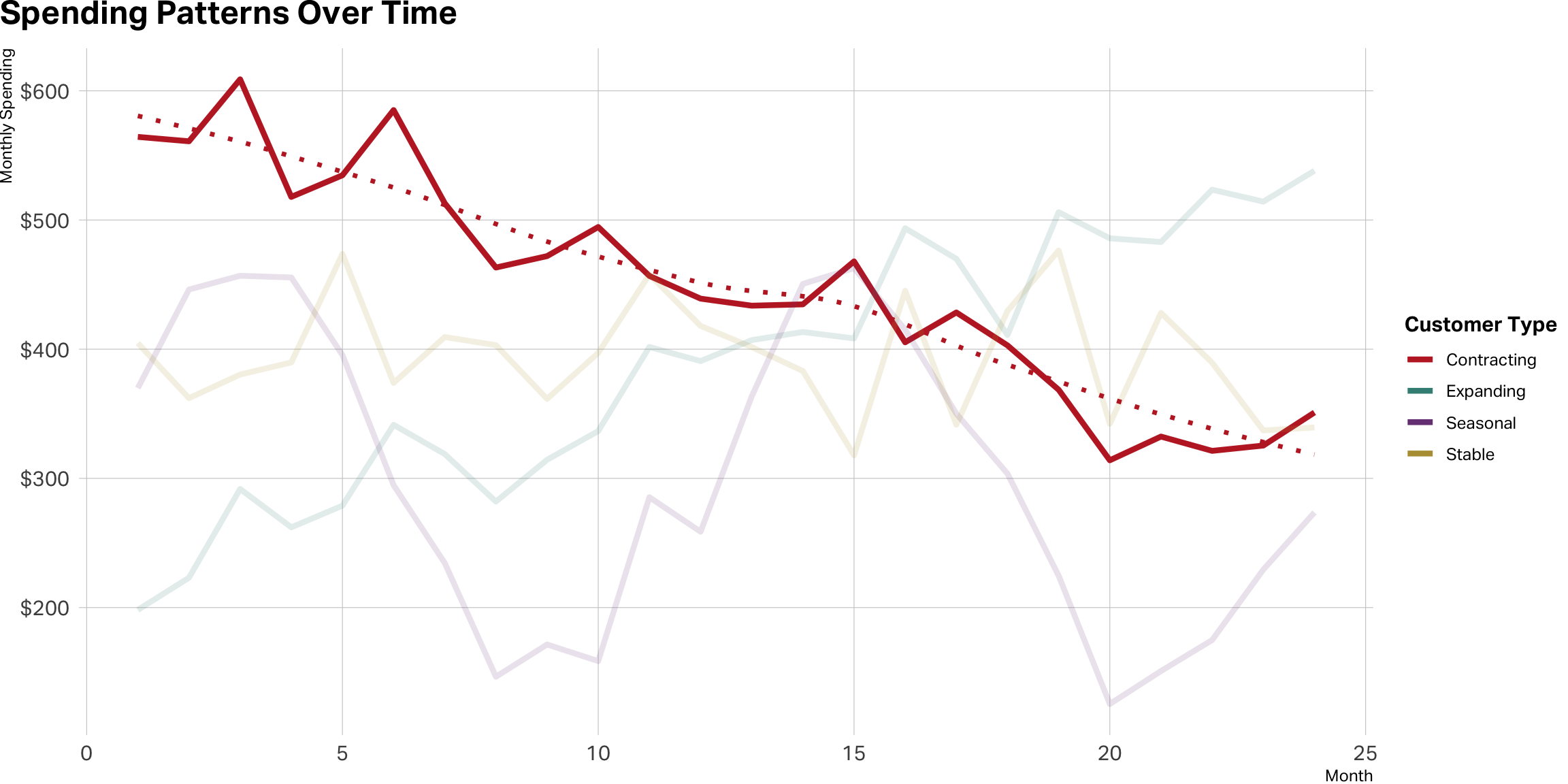

Contraction is a red flag

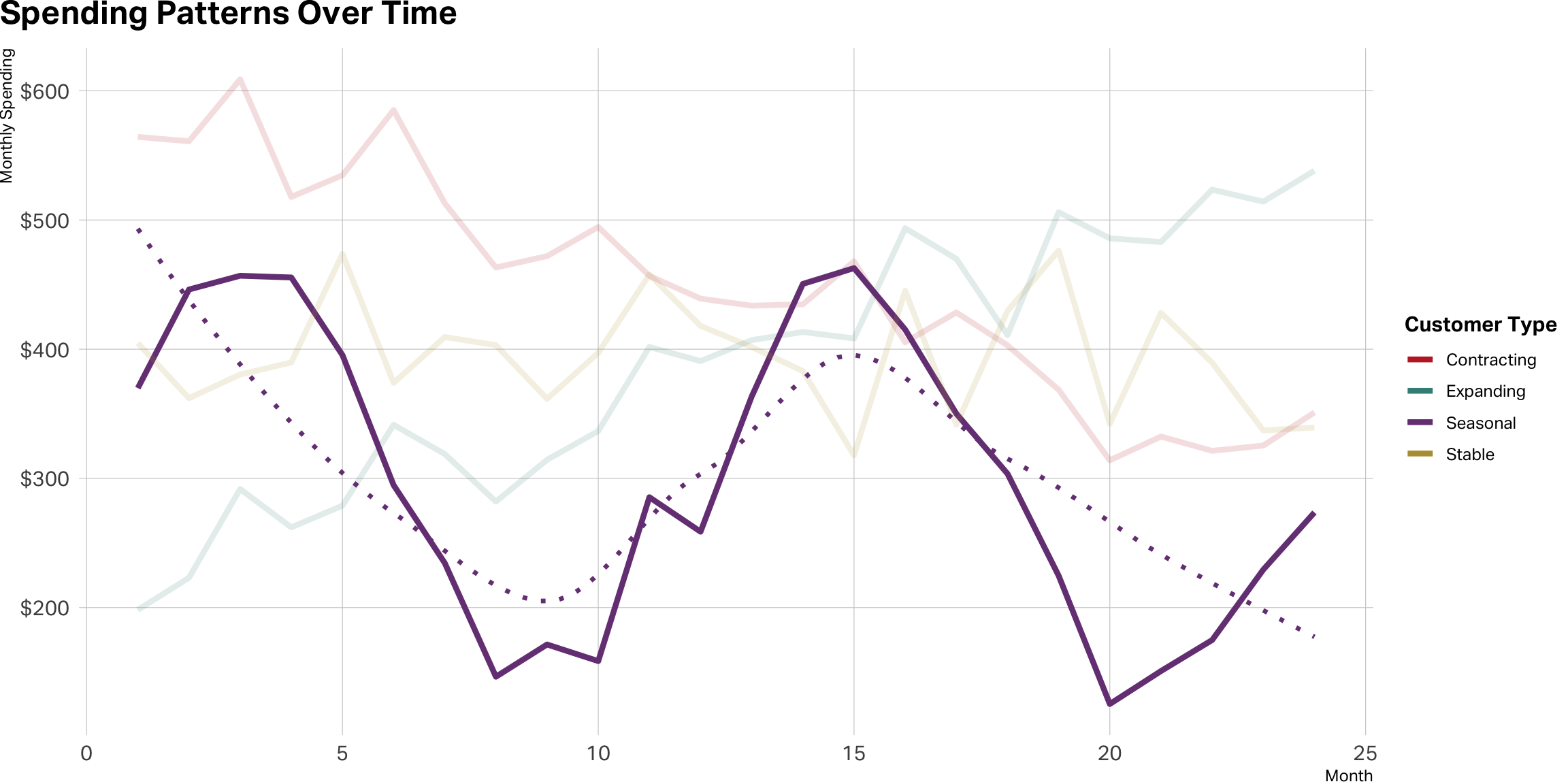

Seasonal cases can be tricky

Takeaway

- Monetary metrics are behavioral signals

- Patterns reveal relationship depth, preferences, and trajectory

- Understanding how customers spend is as important as how much

Next: Velocity — quantifying behavioral change over time

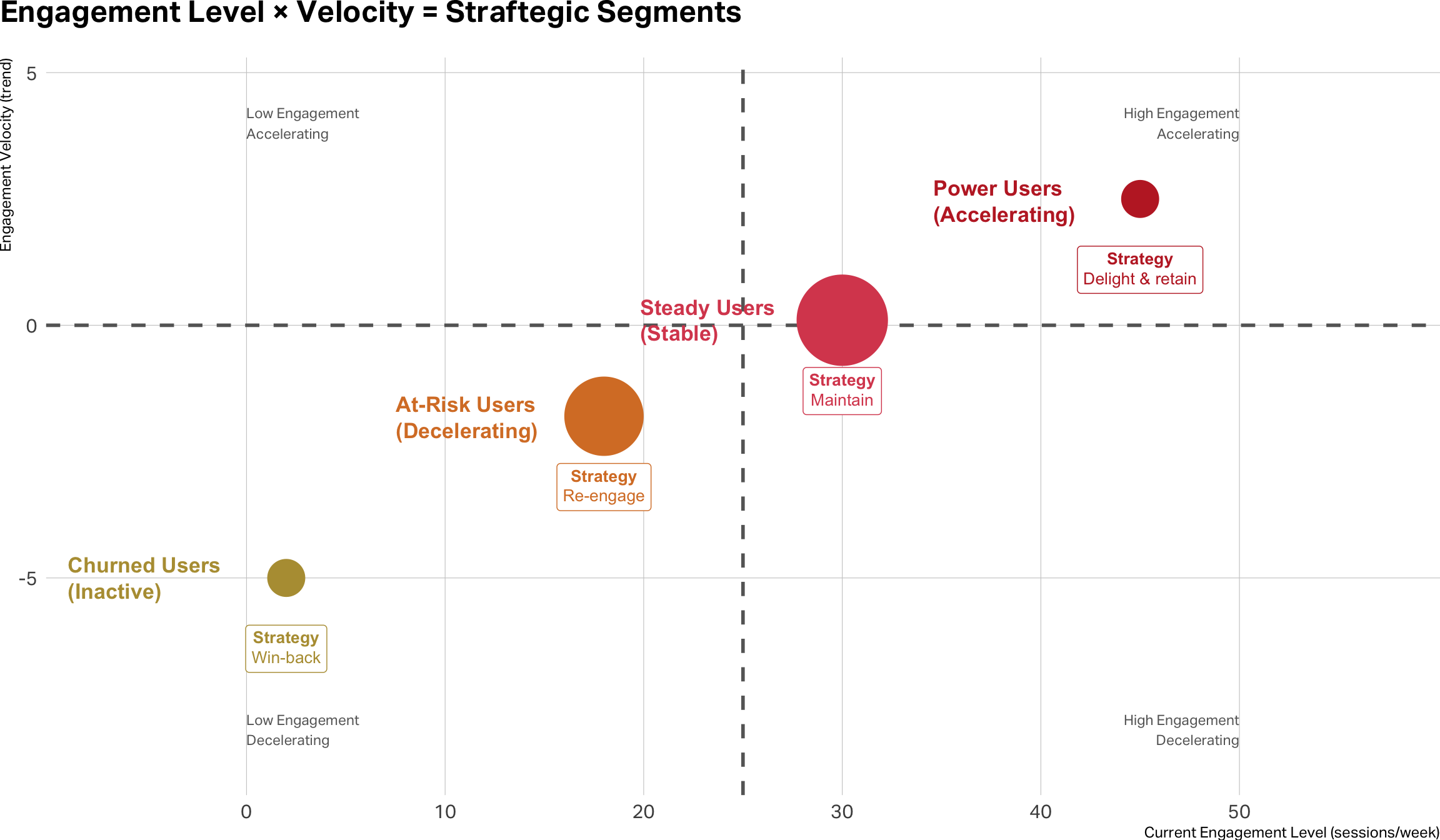

Velocity

Velocity

The rate of change in customer behavior over time, revealing whether engagement is accelerating, decelerating, or stable.

Velocity takes many forms

Context determines which velocity metric matters most for your business

Engagement Velocity

- Login frequency trends

- Content consumption patterns

- Feature usage intensity

- Session duration changes

Transaction Velocity

- Purchase frequency changes

- Time between orders

- Repeat purchase acceleration

Spending Velocity

- Average order value trends

- Basket size growth

- Wallet share expansion

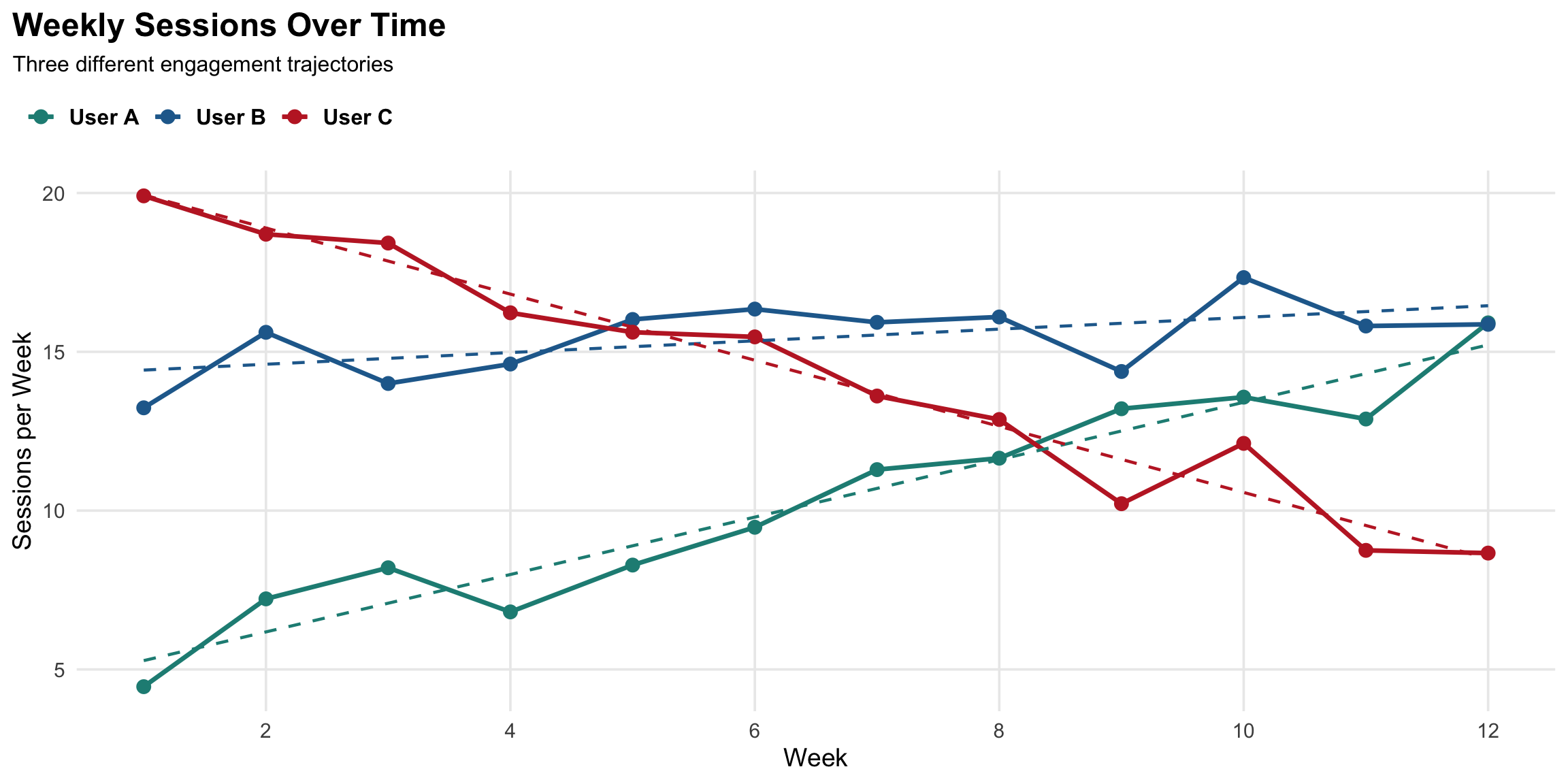

Measuring engagement velocity

Calculating velocity

Simple approach

Period-over-period change

- Week 1-4 average: 8 sessions

- Week 9-12 average: 14 sessions

Velocity = +75% growth

✓ Easy to calculate

✓ Intuitive to interpret

⚠️ Sensitive to outliers

Patterns vs. implications

Real-world velocity metrics

The specific metric varies, but the concept is universal: behavior change over time

Streaming (Netflix, Spotify)

- Hours streamed per week

- Content starts per session

- Days active per month

- Genre exploration rate

SaaS Products

- Daily/weekly active users

- Feature adoption rate

- Time in application

- Collaboration events

E-commerce

- Days between purchases

- Browse-to-buy conversion

- Category expansion

- Cart value trajectory

Social Platforms

- Posts/comments per week

- Connection growth rate

- Engagement with content

- Time on platform

Takeaway

- Velocity adds the temporal dimension

- Static metrics show where customers are → Velocity shows

where they’re going - Early warning system for churn and expansion opportunities

Next: Bringing it together with RFM scoring

RFM Analysis

RFM Analysis

Combining recency, frequency, and monetary metrics to create actionable customer segments for strategic marketing decisions.

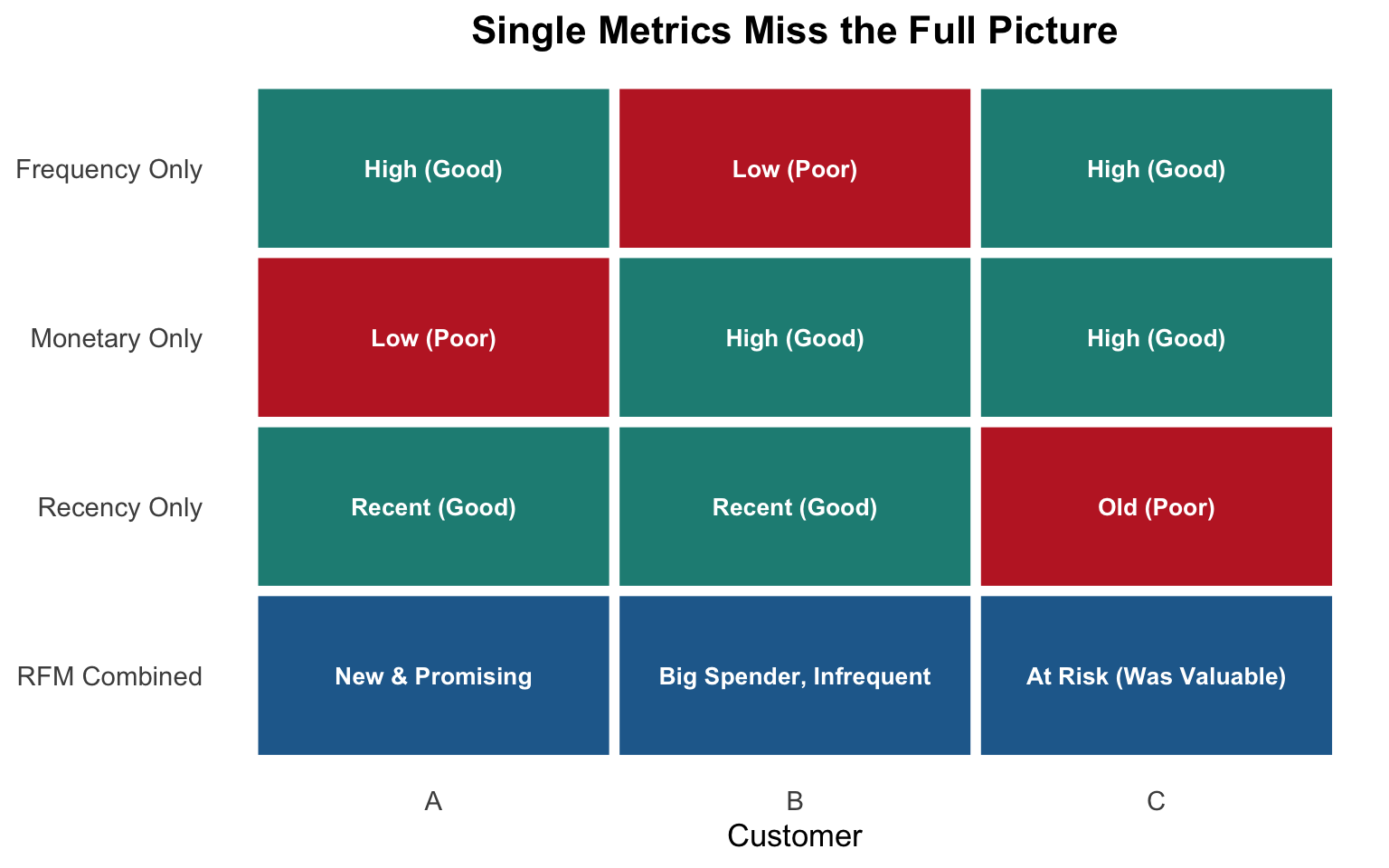

Why combine R, F, and M?

Each dimension alone provides incomplete information. Combined, they reveal distinct customer archetypes requiring different strategies.

Recency alone:

Can’t distinguish new customers from declining ones

Frequency alone:

Misses spending power and engagement timing

Monetary alone:

Ignores relationship trajectory and engagement patterns

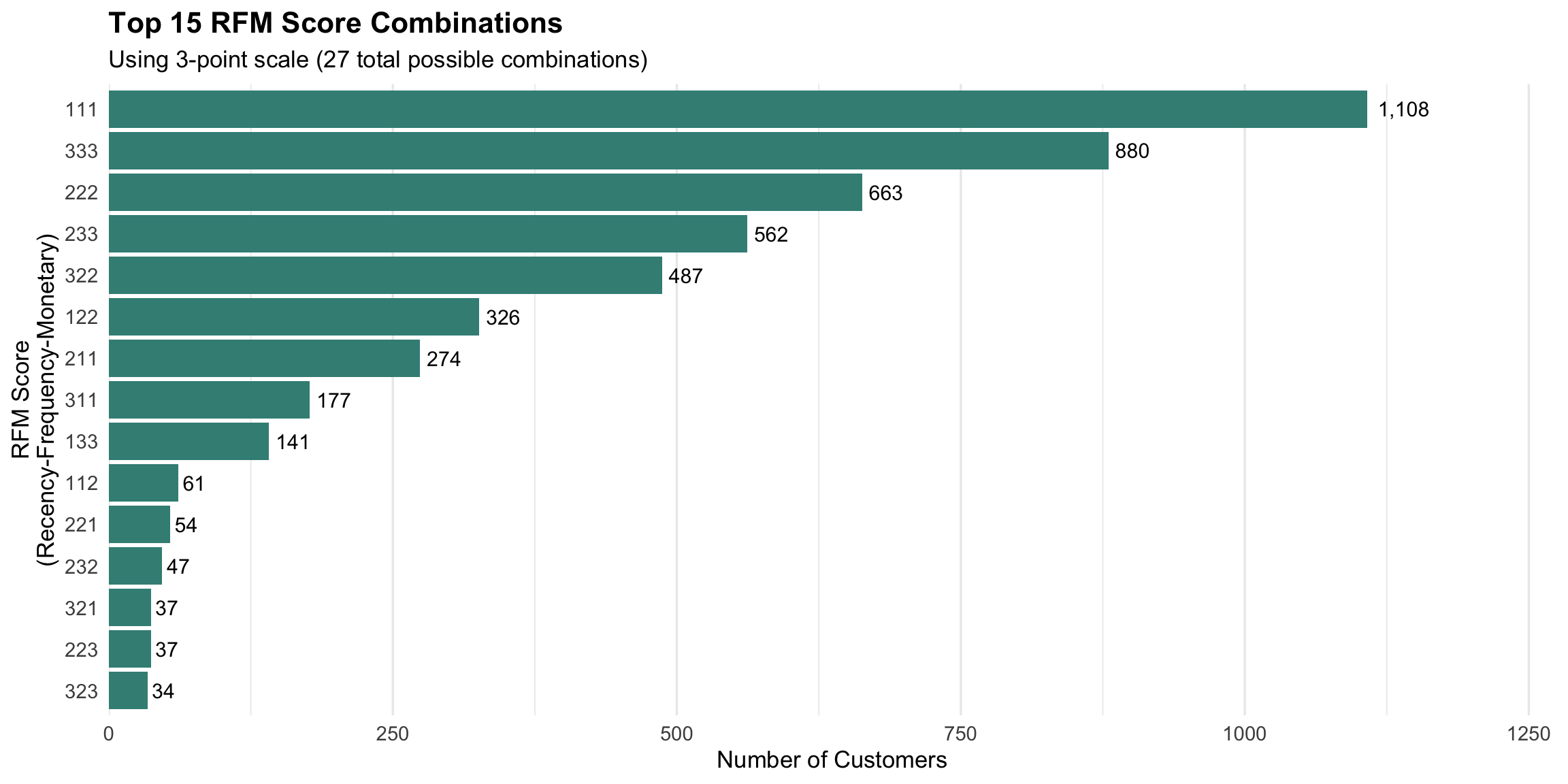

Creating RFM scores

Customers are ranked and divided into groups (typically 3-5) for each dimension, creating a composite score that enables segmentation.

Scoring Approaches:

Quintiles (5-point scale) - Divide customers into 5 equal groups - Score 5 = top 20%, Score 1 = bottom 20% - Creates 125 possible combinations (5³) - More granular, harder to interpret

Tertiles (3-point scale) - Divide customers into 3 equal groups

- Score 3 = top 33%, Score 1 = bottom 33% - Creates 27 possible combinations (3³) - Less precision, easier to act on

# 5-point RFM scoring

customers_rfm <- customers_df %>%

mutate(

R_score = ntile(desc(recency), 5),

F_score = ntile(frequency, 5),

M_score = ntile(monetary, 5),

RFM_score = paste0(R_score, F_score, M_score)

)

# 3-point RFM scoring

customers_rfm <- customers_df %>%

mutate(

R_score = ntile(desc(recency), 3),

F_score = ntile(frequency, 3),

M_score = ntile(monetary, 3),

RFM_score = paste0(R_score, F_score, M_score)

)Score distribution example

Understanding how customers distribute across RFM scores helps identify your most important segments and potential opportunities.

From scores to segments

Individual RFM scores are aggregated into business-relevant segments using rules-based logic, enabling targeted strategies for each customer group.

# Champions: High on all dimensions

champions <- filter(customers_rfm, R_score >= 4 & F_score >= 4 & M_score >= 4)

# Loyal: High F and M, decent R

loyal <- filter(customers_rfm, F_score >= 4 & M_score >= 4 & R_score >= 2)

# At-Risk: Were good (high F/M) but recency dropped

at_risk <- filter(customers_rfm, F_score >= 3 & M_score >= 3 & R_score <= 2)

# Promising: Recent but unproven

promising <- filter(customers_rfm, R_score >= 4 & F_score <= 2)

# Lost: Low on all dimensions

lost <- filter(customers_rfm, R_score <= 2 & F_score <= 2 & M_score <= 2)Common RFM segments

Standard segment archetypes provide a starting framework, though specific definitions should be customized to your business context and customer lifecycle.

| Segment | Typical RFM Pattern | Behavior Profile | Strategy Focus |

|---|---|---|---|

| Champions | 555, 554, 544 | Best customers: recent, frequent, high-value | Retention, VIP treatment, advocacy |

| Loyal Customers | X54, X55 (any R) | High value but may not be recent | Re-engagement, loyalty programs |

| Potential Loyalists | 453, 354, 353 | Recent, showing promise, building engagement | Accelerate frequency, increase basket |

| At Risk | 255, 254, 155 | Previously valuable, declining recency | Win-back campaigns, special offers |

| Need Attention | 333, 233, 323 | Moderate on all dimensions, unclear trajectory | Targeted nudges, prevent decline |

| Promising | 511, 411, 311 | Recent first-time or low-frequency buyers | Onboarding, second purchase incentive |

| Hibernating | 244, 155, 154 | Long inactive but had some historical value | Aggressive win-back or deprioritize |

| Lost | 111, 112, 121 | Unlikely to return, minimal engagement | Win-back with cost constraints or ignore |

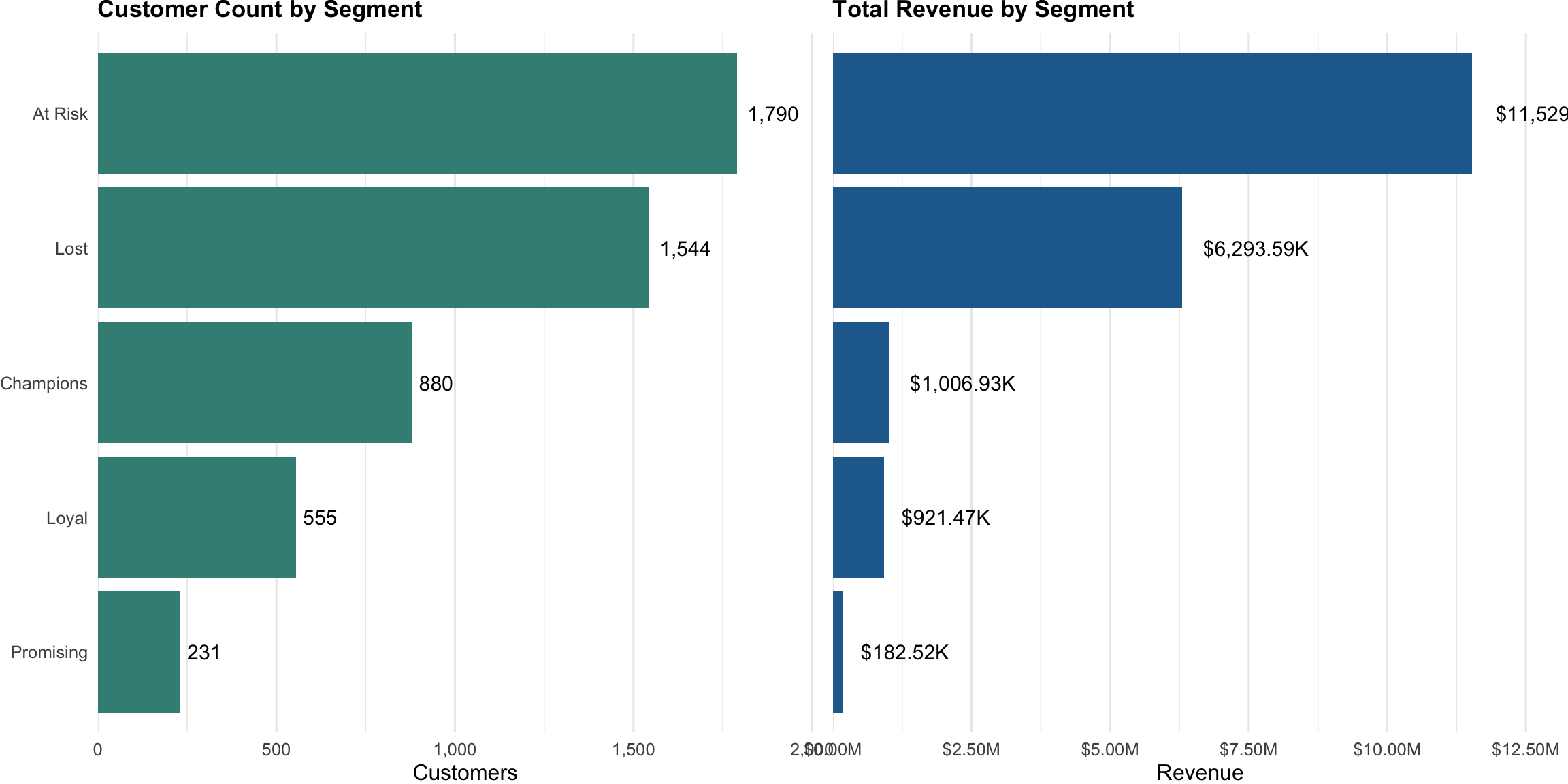

Segment profile analysis

Profiling segments by size, revenue contribution, and average metrics validates segmentation logic and informs resource allocation decisions.

RFM limitations

While powerful for segmentation, RFM has constraints that more sophisticated clustering techniques can address in advanced analysis.

What RFM Does Well

- Simple, interpretable framework

- Actionable segments with clear logic

- Works with minimal data requirements

- Business stakeholders understand it

- Computationally efficient

- Good baseline for many businesses

What RFM Misses

- Arbitrarily groups continuous variables

- Loses information in discretization

- Can’t capture complex, non-linear patterns

- Fixed rules may not fit all customers

- Ignores product/category preferences

- No statistical validation of segments

- Misses velocity and trajectory nuances

Takeaway

- RFM transforms individual metrics into strategic segments

- Provides actionable framework for differentiated marketing

- Foundation for understanding customer value and lifecycle

- Starting point for more sophisticated analytical approaches