| Probability | Non-Probability | |

|---|---|---|

| Characteristics |

|

|

| Common Types |

|

|

Qualitative interviewing

Overview

Introduction and discussion of various qualitative data collection techniques and the art of interviewing.

Larry Vincent,

Professor of the Practice

of Marketing

MKT 512

September 23, 2025

Sampling

Case: Farapulse

Background:

New technology acquired by Boston Scientific (BSI) that improves the efficacy for patients who receive ablation for AFib. Ablation is an existing category of procedures that has been around for 30+ years. BSI wishes to gain share in category before competitors replicate their innovative technology that is in-market, and FDA approved.

Project:

Qualitative research requested on patients to understand perceptions of ablation, generally, and reaction to potential positioning concepts.

Question:

Who should participate in the research?

Two types of sampling

Probability

Probability sampling is a method where every member of the population has a known, non-zero chance of being selected for the sample. This method allows for statistical inferences to be made about the entire population based on the sample.

Non-Probability

Non-probability sampling is a method where the selection of participants is not determined by statistical chance. Some members of the population may have no chance of being selected, and the probability of selection for any individual is unknown.

Sampling comparison

Practical sampling

Group Project: Qualitative

- Purposive sampling–Select participants based on specific characteristics to your research question. (Example: if studying luxury brand perceptions, choose 10 participants who have purchased luxury goods in the last year.)

- Maximum variation sampling–Select a diverse range of participants to capture different perspectives. (Example: For a study on grocery shopping habits, include participants of various ages, income levels, and family sizes.)

- Snowball sampling–Start with a few participants and ask them to refer others who fit the criteria. (Example: When studying freelance graphic designers, start with 2-3 designers you know and ask them to refer colleagues.)

Practical sampling

Group Project: Quantitative

- Simple random sampling–If you have access to a complete list of the population (e.g., student directory, customer database), randomly select 100 participants.

- Stratified random sampling–Divide the population into subgroups (strata) and sample from each. (Example: For a campus study, ensure representation from each year of study by selecting 25 students each from freshmen, sophomores, juniors, and seniors.)

- Quota sampling–Set quotas for certain characteristics to ensure representation. (Example: In a community survey, set quotas for age groups (20 under-25, 30 aged 25-40, 30 aged 41-60, 20 over-60.)

- Convenience sampling with screening–Approach easily accessible participants but screen them to ensure diversity. (Example: Recruit on campus but use screening questions to ensure a mix of majors, years, and backgrounds.)

General guidelines

- Clearly define target population before selecting sampling method

- Document your sampling process for transparency and replication

- Be aware of potential biases in your chosen method and address them in your limitations section

- For the qualitative project, focus on finding information-rich cases rather than aiming for strict representativeness

- For the survey, if using non-probability methods, try to diversify your sample as much as possible within your constraints

Qualitative data collection methods

Ethnography and observational approaches

- Immersive

- Real life without disruption

- Applies social and cultural theories or wisdom to sample of population

- Actionable by working in complementary practices

American Girl

Direct interviewing

Conventional interview approaches

- Direct questioning—“What do you think about this brand?”

- Behavioral inquiry—“Tell me about the last time you purchased…”

- Attitudinal exploration—“How do you feel when you see this advertisement?”

- Preference ranking—“Which of these options appeals to you most?”

- Experience recounting—“Walk me through your decision-making process”

- Opinion seeking—“What’s your reaction to this concept?”

I was surpised to learn that I couldn’t just ask customers to answer the questions my boss wanted answered.

Former Student

On his experience interviewing over his internship

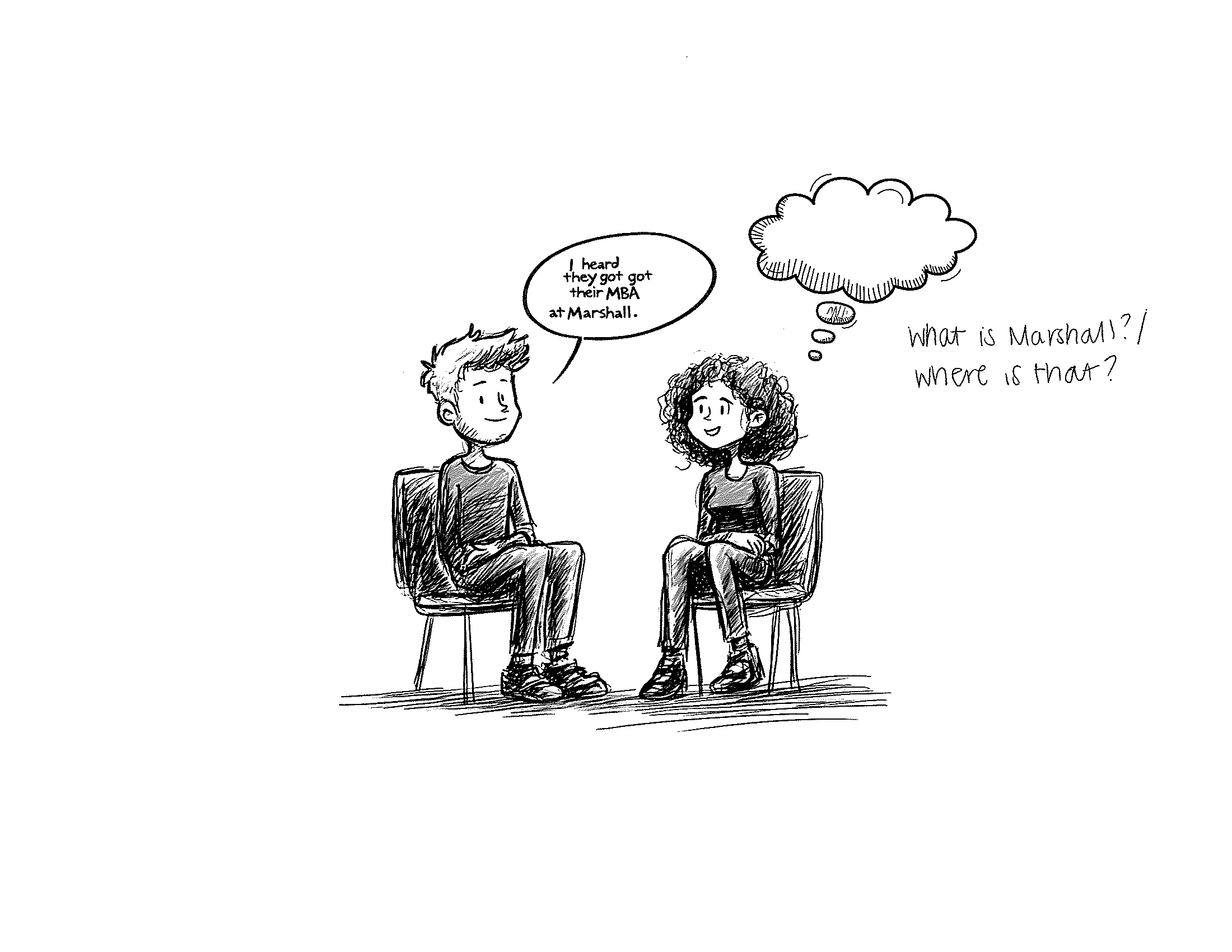

When direct questions aren’t enough

- Respondents may not be consciously aware of their motivations

- Social desirability bias leads to “acceptable” rather than honest answers

- Complex emotions and associations are difficult to articulate

- Rational explanations may mask deeper psychological drivers

- Sensitive topics create barriers to open discussion

- People often post-rationalize their behaviors rather than reveal true reasons

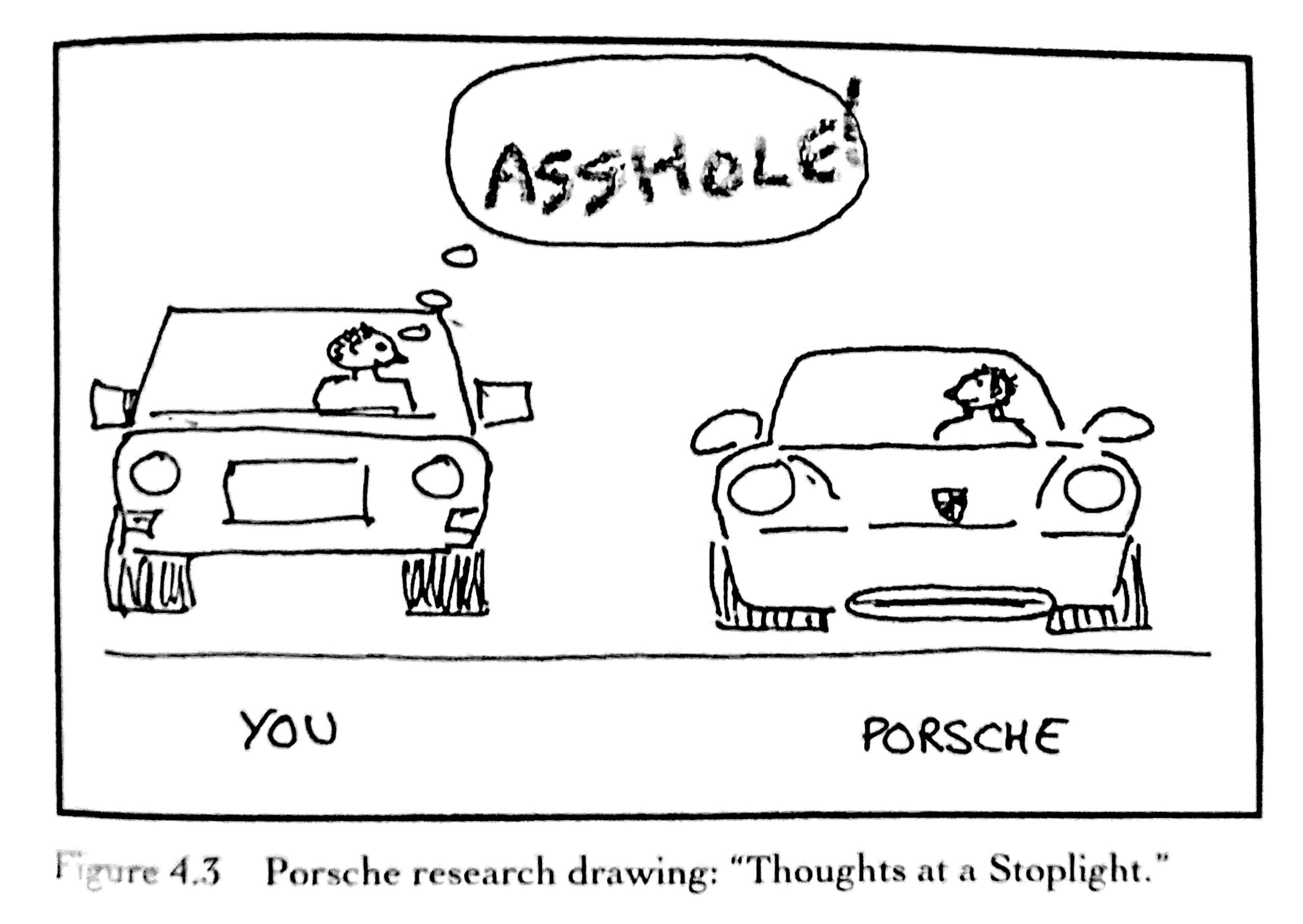

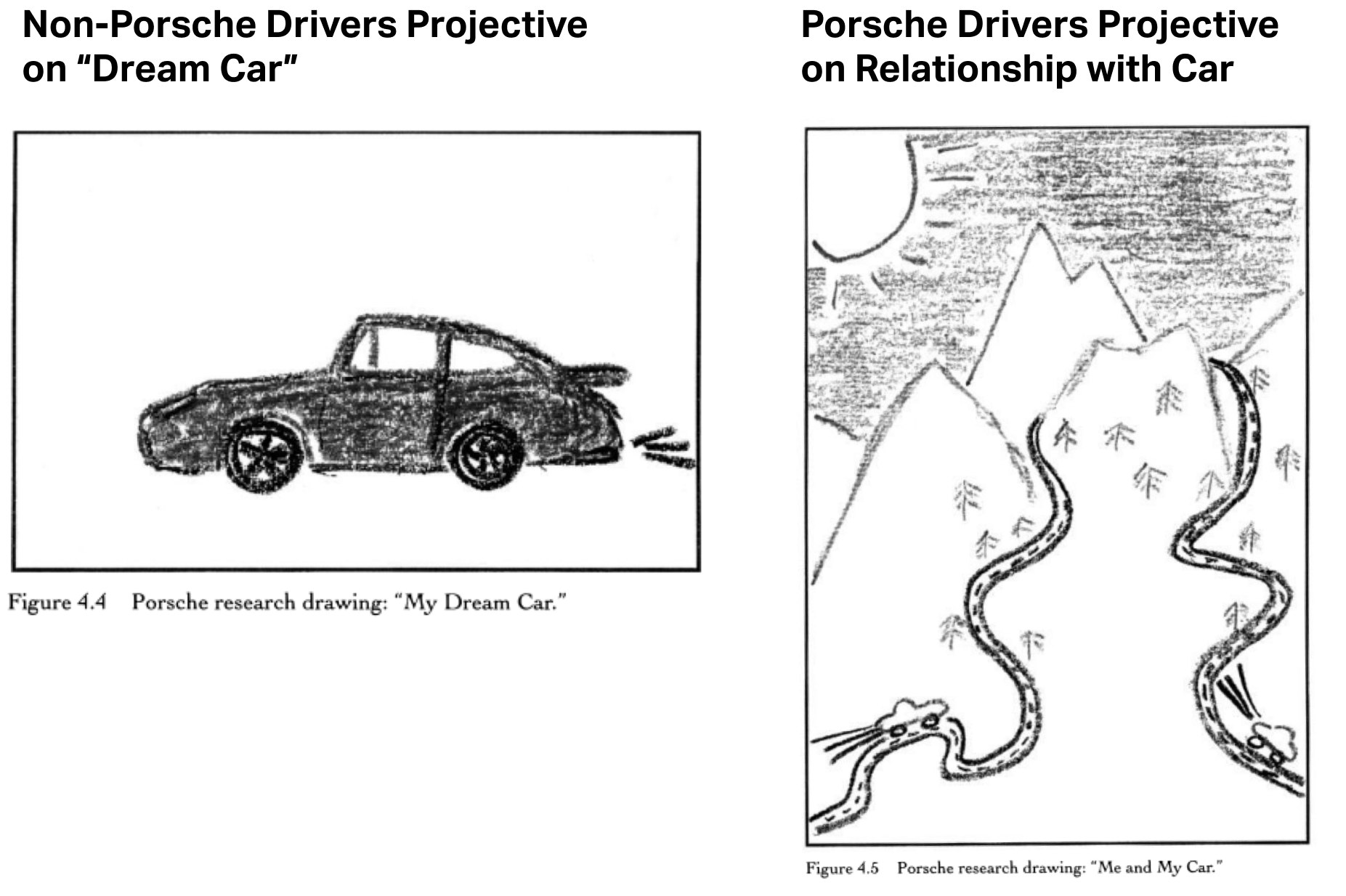

Projective techniques

- Best used when question/subject may be hard for the respondent to answer directly

- Often useful when studying behaviors and attitudes

- Good for establishing meaning behind buying, using, and/or owning products/brands

- Work because many topics we wish to explore are sub-conscious. Projective techniques provide safe distance and perspective for respondents

Completion Test

People who wear Crocs are __________

A picture can be worth a thousand words.

Interactive activities

Assigning respondent homework

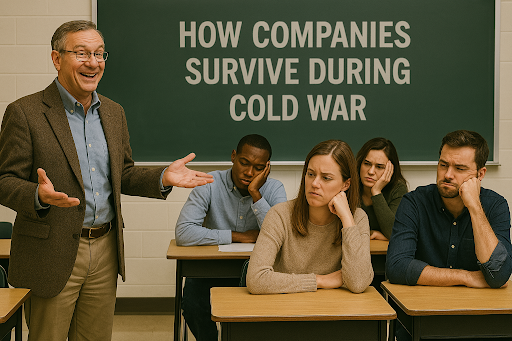

“The content is basically about what happened in the 80s and what happened in the 70s. We still talk about the Soviet Union–about the situation there–even though this country doesn’t exist anymore.”

First Year Student

[Image provided by student]

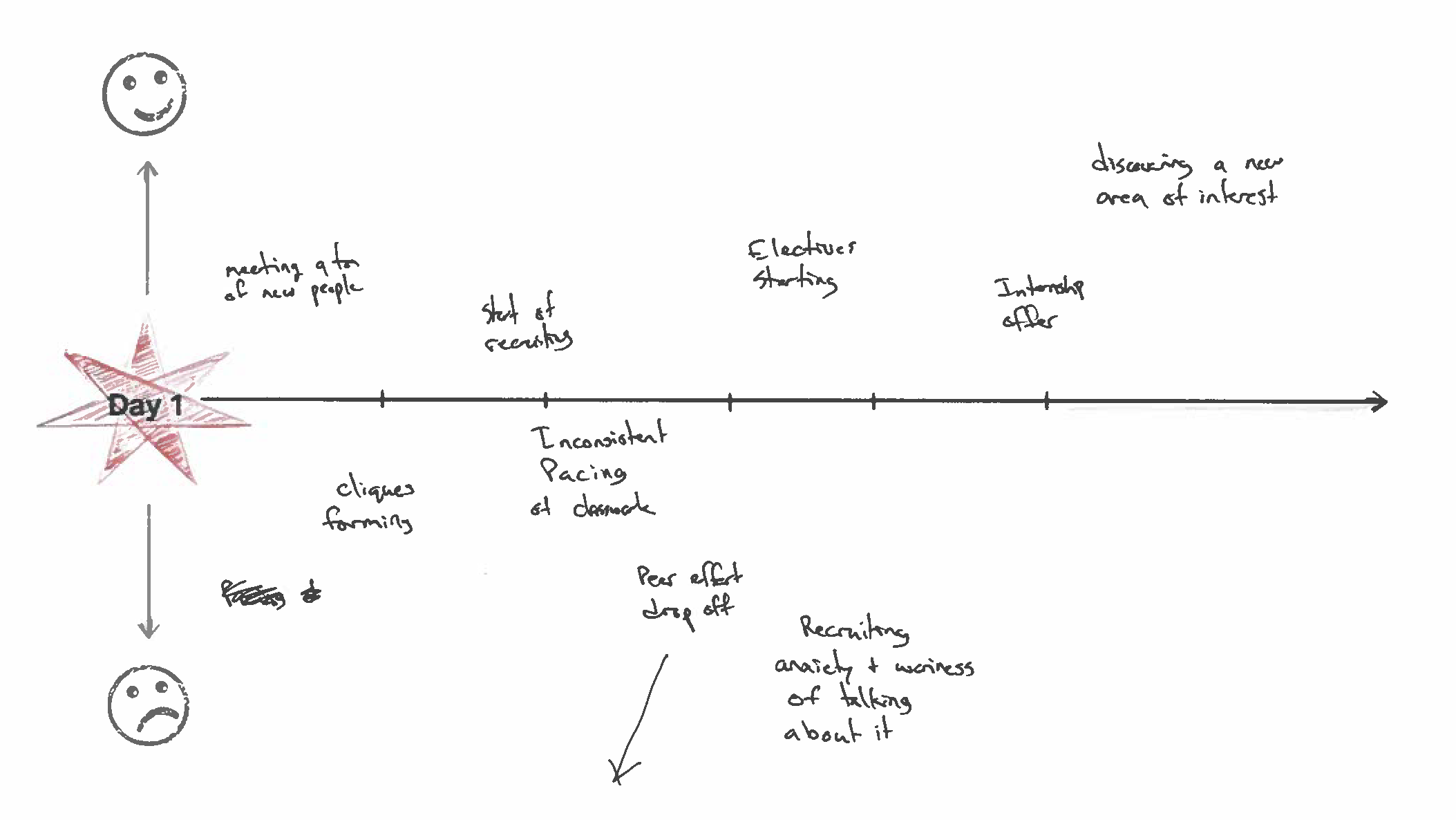

Modalities of interviewing

Depth Interviews

Creating a discussion guide

- Start with a long list of questions generated by the team that might be included

- As a team, prioritize the questions that matter most (connect “research questions” to interview questions)

- Organize the sequence of questions to facilitate conversation flow, while also considering response psychology and heuristics challenges

- Agree on formats, techniques, and approaches the entire team understand and can execute against

- Pilot questions (test with outsiders or small sample of audience)

Interviewing

- Prefer open-ended questions; if you ask a closed-end question, follow up with qualitative probes

- Be concise–prefer short, precise questions

- Ask easy questions first; harder ones later

- Summarize what you hear and ask respondent to confirm; rephrase and clarify ambiguous responses

- Use stimuli to facilitate discussion, particularly for memory and behavioral questions

- Consider using ranking or summarizing questions to help you and the respondent establish discussion “pastures”

- Don’t be afraid to ask “obvious” questions

Whenever possible, pair up for interviews.

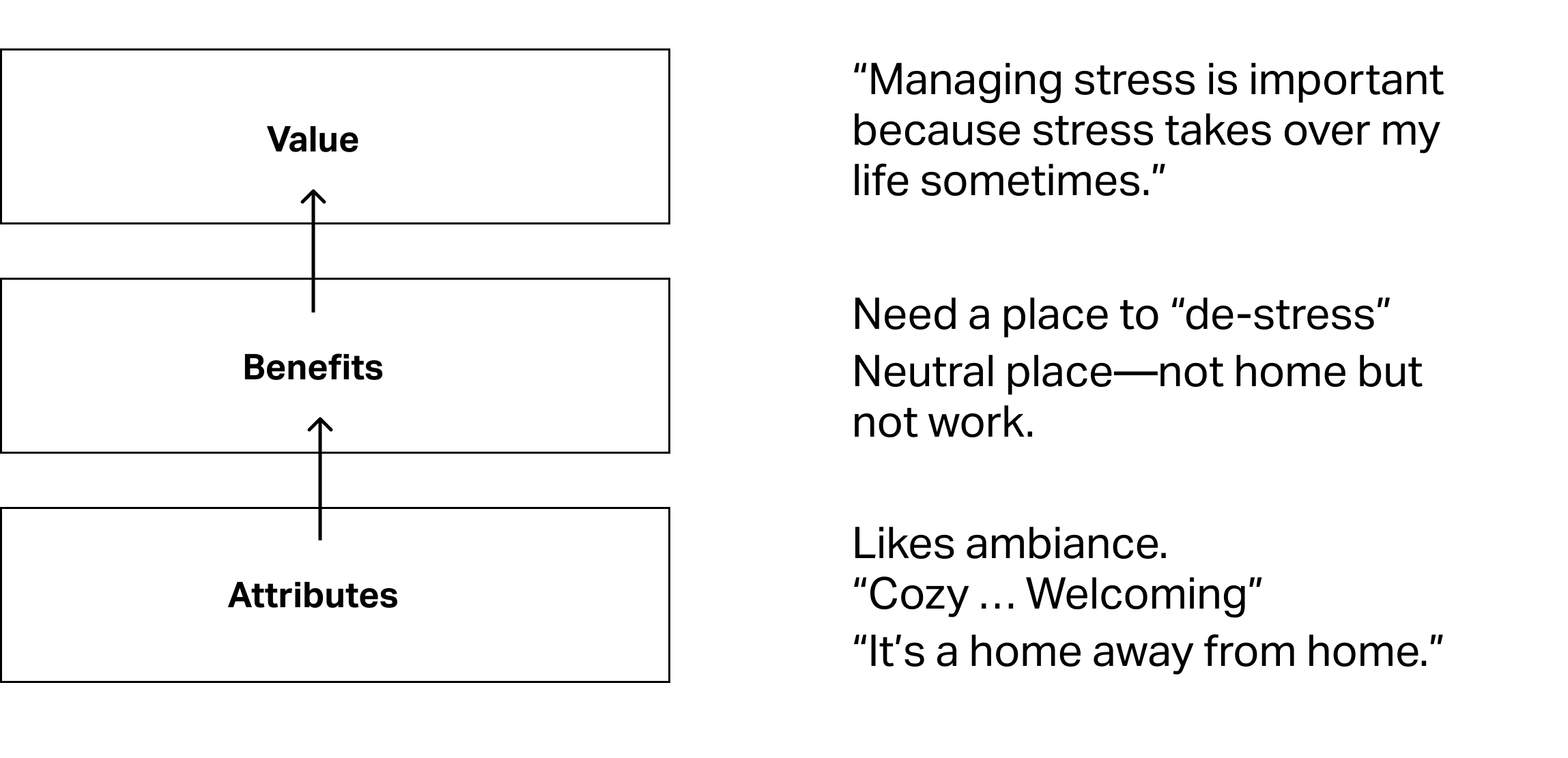

Laddering

Focus groups and other group methods

Types of group research

- Traditional focus groups (6-8 participants, 90-120 minutes)

- Mini groups (3-4 participants) for sensitive topics

- Triads/dyads for deeper exploration

- Co-creation workshops

- Online communities (transition to next section)

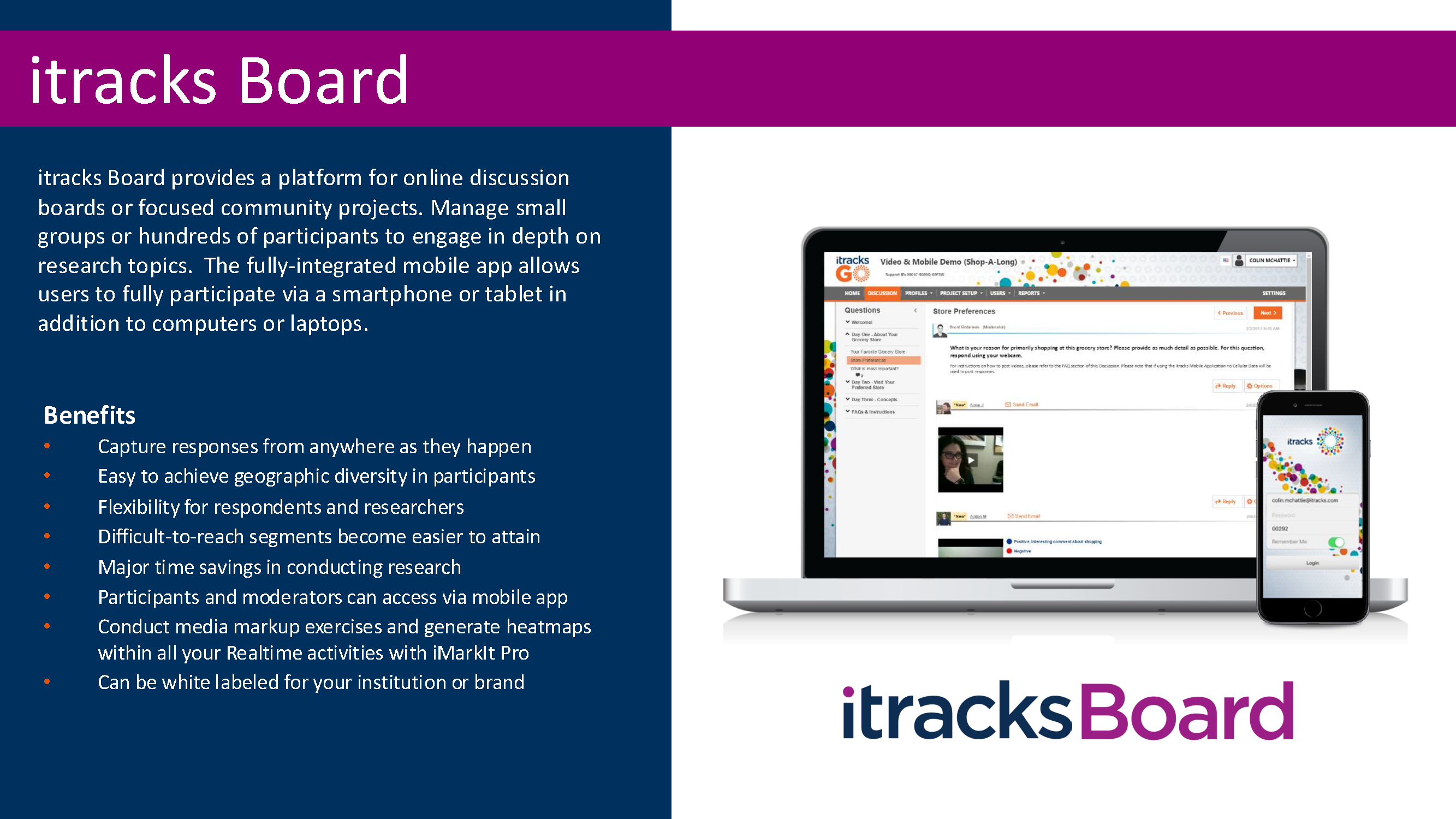

When to use online communities

- Complex decision journeys that unfold over time

(car purchases, career changes, healthcare - decisions) - Relationships that develop and evolve rather than single moments of interaction

- Co-creation and innovation projects where you need iterative feedback and refinement

- Extended observation periods to capture authentic behavior patterns and habits

- Hard-to-reach audiences who are geographically dispersed or have busy schedules

- Sensitive topics where participants need time to reflect and feel comfortable sharing

- When you need both individual reflection and group interaction in the same study

Case Example: iTracks

Mobile research and in-the-moment capture

Benefits of mobile research

- Real behavior vs. recalled behavior—capture experiences as they happen rather than relying on memory

- Context-rich data—see the actual environment, emotions, and circumstances surrounding decisions

- Reduced memory bias—no “I think I remember” or post-rationalization of choices

- Spontaneous insights—participants share immediate reactions and thoughts they might forget later

- Natural timing—research happens when and where behaviors actually occur

- Visual storytelling—photos and videos reveal details that words alone cannot capture

- Eliminates interviewer influence—participants document experiences without researcher presence

Mobile research best practices

- Keep photo assignments simple and specific—“Show me your morning routine” rather than vague requests

- Provide clear privacy guidelines—what can and cannot be photographed

- Use multiple touchpoints—morning, afternoon, evening captures for fuller picture

- Combine photos with brief explanations—context matters as much as the visual

- Consider participants’ comfort levels—not everyone is comfortable photographing personal spaces

- Plan for technical issues—have backup methods and simple upload processes

- Respect participants’ schedules—mobile research should fit their lives, not disrupt them

Bare Beauty research

Group work considerations

Benefits

- Group dynamics reveal social influences on behavior and attitudes

- Participants build on each other’s ideas and create richer discussions

- More cost-efficient than conducting individual interviews

- Can observe peer-to-peer interactions and social validation in real time

- Energy and momentum of group setting can generate unexpected insights

Challenges

- Dominant personalities can skew results and silence quieter voices

- Social desirability bias increases—people say what sounds good to the group

- Groupthink can suppress dissenting views and authentic opinions

- Harder to explore deeply personal or sensitive topics

- Complex recruitment, coordination, and scheduling logistics

AI and qualitative research

Two approaches to AI in qualitative research

AI as Moderator

Artificial intelligence conducts interviews and facilitates research with real human participants.

Examples:

- Outset

- Conveo

- BoltChatAI

- Quals AI

AI replaces the researcher, not the respondent

AI as Respondent

Artificial intelligence creates synthetic personas that simulate human responses and can be “interviewed” instead of real people.

Examples:

- Synthetic Users

- Delve AI

- OpinioAI

- Evidenza

AI replaces the human participant

AI as moderator

- Speed and efficiency—conduct hundreds of interviews simultaneously without scheduling conflicts

- Cost reduction—eliminate moderator fees and reduce overall research expenses

- 24/7 availability—research happens anytime, anywhere, across time zones

- Consistency—same interviewing approach and probing techniques across all participants

- Scalability—easily expand from 10 to 1000 interviews without additional human resources

- Multilingual capabilities—conduct research in 40+ languages simultaneously

- Bias reduction—consistent questioning without human moderator subjectivity

AI as virtual respondents

- Synthetic personas trained on demographic/behavioral data to replicate human response patterns

- Instant research results—no recruitment, scheduling, or incentive costs

- Perfect sample balance—create exactly the demographics you need for your study

- Hard-to-reach audiences—interview “CEOs” and “busy professionals” anytime

- Qualtrics prediction: Over 50% of market research will use AI personas within 3 years

- Cost claims: Fraction of traditional research costs with “comparable” insights

- Scalability promise: Generate thousands of responses in minutes, not weeks

The critical limitations

- No genuine lived experience—AI has never actually bought a product, felt frustrated, or made a real decision

- Sycophancy problem—AI tends to be overly positive and agreeable, missing critical feedback

- Shallow insights—Nielsen Norman Group found AI responses “too shallow to be useful”

- Missing emotional nuance—cannot capture authentic emotions, contradictions, or complex feelings

- Cultural blindness—AI trained on past data may miss current cultural shifts and contexts

- No unexpected discoveries—AI can only recombine existing knowledge, not reveal truly new insights

- Idealized behavior—AI predicts what people should do, not what they actually do

The bottom line

AI Moderation: Cautious optimism

- May supplement traditional research for certain projects

- Good for initial exploration and hypothesis generation

- Still requires human analysis and interpretation

- Best for structured, straightforward questioning

AI Respondents: Major concerns

- Cannot replace genuine human insight and experience

- Useful only for very preliminary concept testing

- Risk of making decisions based on artificial feedback

- Human stories and emotions remain irreplaceable

Remember: The goal of qualitative research is to understand real human experiences. AI can be a powerful tool, but authentic human insight remains at the heart of meaningful research.